2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

New Technology Is Powering the Real Estate Process

Technology Is Powering the Real Estate Process Technology is the driving force behind many of today's real estate transactions. Let’s connect to discuss how working together to go digital can give you an edge when buying or selling your home.

Uncertainty Abounds in the Search for Economic Recovery Timetable

Uncertainty Abounds in the Search for Economic Recovery TimetableEarlier this week, we discussed how most projections from financial institutions are calling for a quick V-shaped recovery from this economic downturn, and there’s research on previous post-pandemic...

Keys to Selling Your House Virtually

Keys to Selling Your House VirtuallyIn a recent survey by realtor.com, people thinking about selling their homes indicated they’re generally willing to allow their agent and some potential buyers inside if done under the right conditions. They’re less comfortable,...

Will This Economic Crisis Have a V, U, or L-Shaped Recovery?

Will This Economic Crisis Have a V, U, or L-Shaped Recovery?Many American businesses have been put on hold as the country deals with the worst pandemic in over one hundred years. As the states are deciding on the best strategy to slowly and safely reopen, the big...

The Pain of Unemployment: It Will Be Deep, But Not for Long

The Pain of Unemployment: It Will Be Deep, But Not for LongThere are two crises in this country right now: a health crisis that has forced everyone into their homes and a financial crisis caused by our inability to move around as we normally would. Over 20 million...

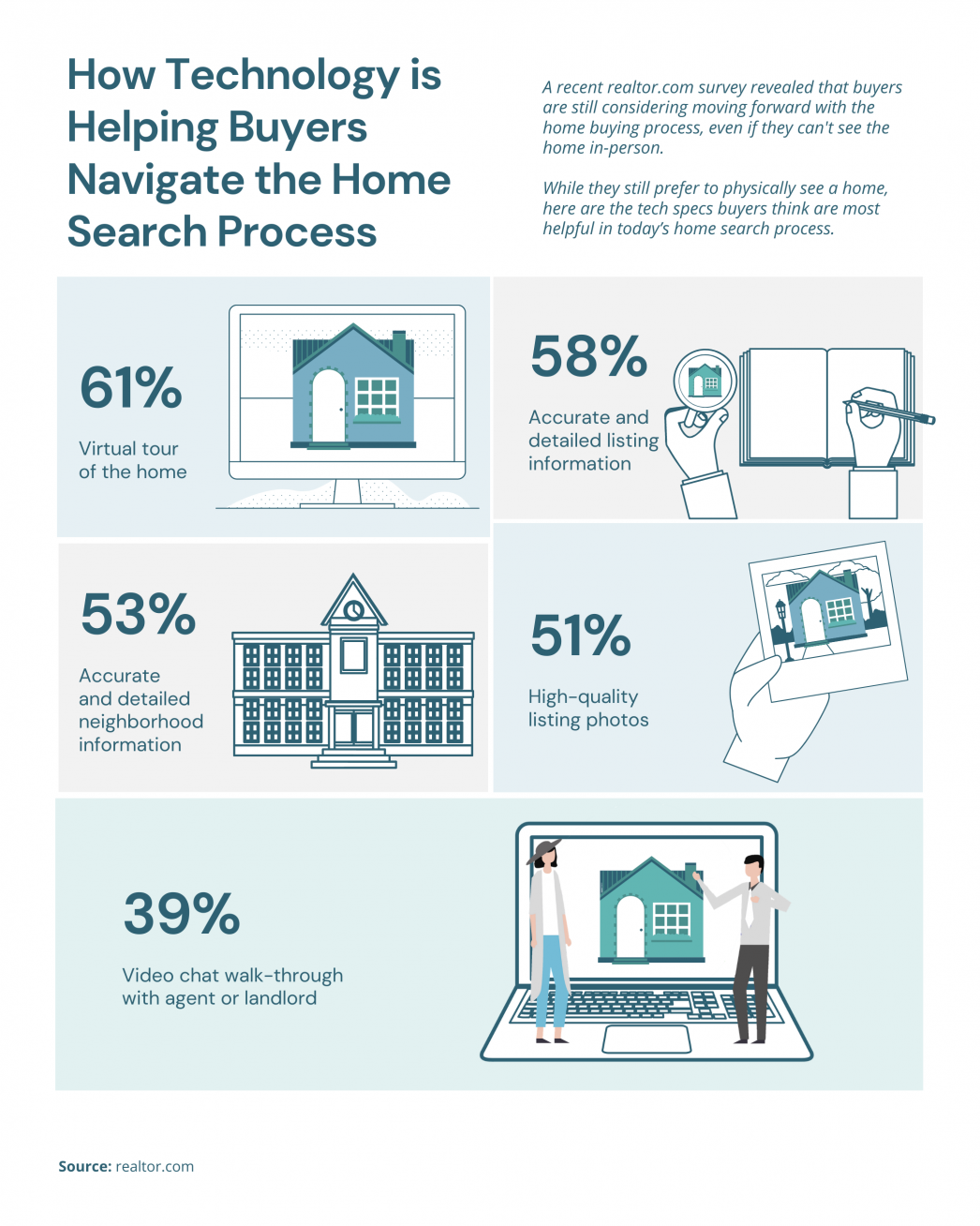

How Technology is Helping Buyers Navigate the Home Search Process

How Technology is Helping Buyers Navigate the Home Search Process Some Highlights:A recent realtor.com survey revealed that buyers are still considering moving forward with the homebuying process, even if they can’t see the home in-person.While they still prefer to...

A Recession Does Not Equal a Housing Crisis

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

Today’s Homebuyers Want Lower Prices. Sellers Disagree.Utah Single Family Inventory has risen from 5775 to 5940 from April 5th to April 16th.Utah County Single Family Inventory April 5th was 1401, April 16th up a little to 1466Salt Lake County Single Family Home...

Think This Is a Housing Crisis? Think Again.

Think This Is a Housing Crisis? Think Again.With all of the unanswered questions caused by COVID-19 and the economic slowdown we’re experiencing across the country today, many are asking if the housing market is in trouble. For those who remember 2008, it's logical to...

What If I Need to Sell My Home Now? What Can I Do?

What If I Need to Sell My Home Now? What Can I Do?Every day that passes, people have a need to buy and sell homes. That doesn’t stop during the current pandemic. If you’ve had a major life change recently, whether with your job or your family situation, you may be in...