2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Home Prices Are Back on the Rise

Home Prices Are Back on the Rise Some Highlights Looking at monthly home price data from six expert sources shows the worst home price declines are behind us, and they’re rising again nationally. If you’ve put your plans to move on pause because you were worried about...

About 11,000 Houses Will Sell In The USA Today

About 11,000 Houses Will Sell Today Some homeowners have been waiting for months to put their house on the market because they don’t think people are buying homes right now. If that’s you, know that even though the housing market has slowed compared to the frenzy of a...

There’s Only Half the Inventory of a Normal Housing Market Today

There's Only Half the Inventory of a Normal Housing Market Today Wondering if it still makes sense to sell your house right now? The short answer is, yes. Especially if you consider how few homes there are for sale today. You may have heard inventory is low right now,...

Things To Know When Getting Ready To Buy A Home

Things To Know When Getting Ready To Buy A Home Are you in the market to buy your dream home? Congratulations! This is an exciting step in your life, but it can also be overwhelming and confusing at times. From navigating the financial aspects to understanding the...

Considering Selling Your Home As A Senior?

Considering Selling Your Home As A Senior? Let A Senior Real Estate Specialist (SRES) Be Your Guide! Are you a senior considering a move or possibly selling your home? Making decisions related to real estate can be overwhelming, especially as you enter the golden...

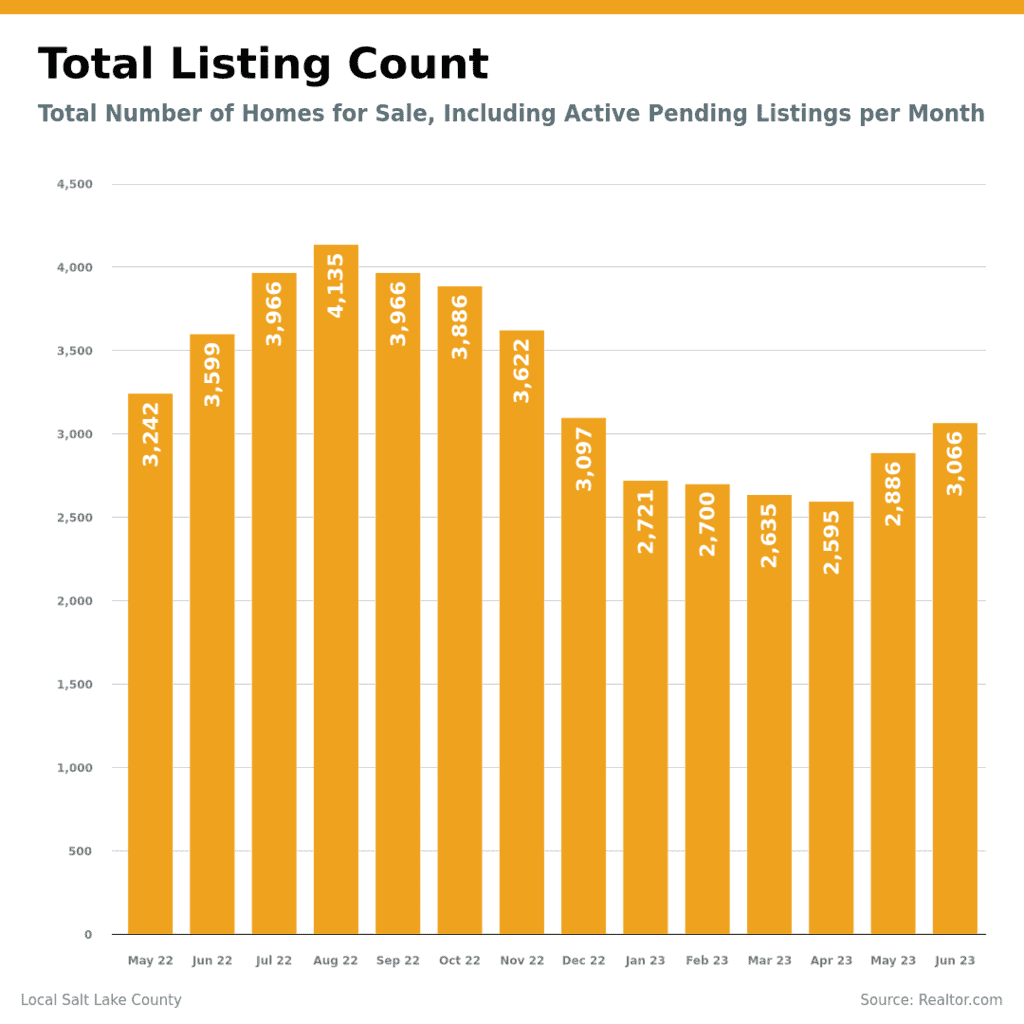

Salt Lake County Market Insights By Marty Gale Utah Realty

Salt Lake County Market Insights from May 2022 to June 2023 Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General...

What Makes A Great Real Estate Agent

What Makes A Great Real Estate Agent Are you on the hunt for your dream home or perhaps looking to sell your property for top dollar? Choosing the right real estate agent is essential in ensuring a smooth and successful transaction. But what exactly sets apart a...

Are you or a loved one facing the prospect of downsizing? It can be an overwhelming process.

Marty's Monday Blog Are you or a loved one facing the prospect of downsizing? It can be an overwhelming process, filled with practical and emotional challenges. That's why utilizing the expertise of a Senior Real Estate Specialist (SRES) can make all the difference....

Key Housing Market Trends

Key Housing Market Trends Some Highlights If you’re considering buying or selling a home, you’ll want to know what’s happening in the housing market. Housing inventory is still very low, prices are climbing back up, and homes are selling fast when priced right. If you...

Economic Trends And Factors Influencing The Luxury Home Market In Utah

Welcome to our blog article all about the exciting developments and trends in Utah's luxury home market this fall! As the leaves change color and the cool autumn breeze settles in, Utah's real estate market is buzzing with activity. Whether you're a potential buyer or...