If you need help with a family estate we have the expertise and certification in this field. I you just are getting starting with the probate process or are 90 days in. We’re here to guide you. Are main focus is the sale and liquidation of the real estate assets in probate.

Keeping your family safe and free of debt collectors and added stress after passing on is of utmost concern.

Hiring a Certified Probate Real Estate Specialist is a good way to avoid unforeseen headaches.

12 most common mistakes an administrator or executor can make during probate and how to avoid them.

What follows below is a list of common mistakes that can be costly if not voided. We encourage you to read thoroughly. It has helped many executors and administrators alike and we hope it can assist you as well.

No outcome in mind

Beginning with the end in mind provides clarity and focus throughout the entire probate process. Although it can be an overwhelming experience (especially if the decedent is your close relative), it does not have to be stressful, if you have a clear reminder of and commitment to what the end goal is. Here are some examples: peace of mind, pay off debt and taxes a.s.a.p., settle with heirs, and maximize value of estate, just “be done with it and get it over” and others. Whatever the end goal is, it must be agreed upon by all so that you get support and have confidence in the decisions you make as the

executor/administrator.

Not educating yourself on the probate process and deciding if you need / want a lawyer

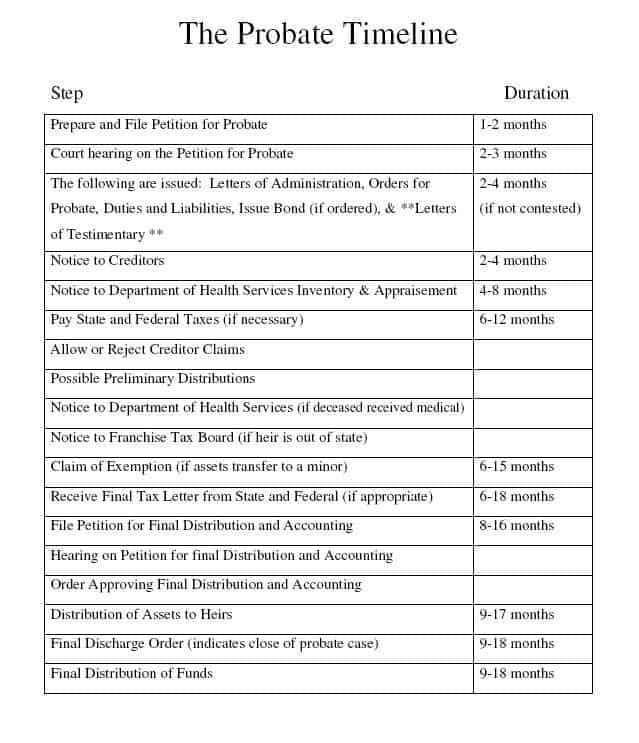

You can educate yourself on our site about the process and read the timelines and/or go to your local courthouse to get more information. Once informed, it does make a lot of sense to talk to an attorney about the process and see what he/she thinks might be appropriate in your situation. You may then decide that you can handle this “pro per” meaning without a lawyer and represent the estate yourself as you go through the probate process.

Relying on your attorney for EVERYTHING

You might decide to use an attorney because your case might be slightly complicated or the estate is not in your hometown or state or you simple have no time on your hands. Your probate attorney is an expert in his field and will be paid as such. If you rely on your attorney for expertise such as taxes, securing the real estate, selling real estate, maintaining property, etc. you are not fully using local talent and maximizing the value of the estate. Financial planners, CPA’s, local realtors, contractors and estate planning firms are experts in their perspective field and can give you specialized knowledge which pays off in both the short run and long term.

Marketing real estate too late

Do not make the mistake of waiting too long to market any real estate, if you’d like to settle the estate as quickly as possible. Once you have been approved as the executor of the estate, you can begin soliciting offers on the real estate. In other words, parallel to handling everything else, you can list with a realtor, get advice, solicit offers and even go into escrow. Escrow will not close until you have acquired letters testamentary / letters of administration. As long as your buyers are aware of this, you will do fine. Be sure to use a realtor that understands probate.

Securing and maintaining real estate. You are responsible

Now that you are responsible for the real estate that means you must make sure it is secured and properly maintained. If you are not in the same city or state this can become a challenge for you, especially if curb appeal suffers and squatters take over. A good realtor that understands your probate needs can also help you maintain the property by using people in his/her network.

Choosing friends over the right professionals to do a particular job

Now that you might need an attorney, realtor, tax advisors, financial planning and estate planning, you can find yourself surrounded by well meaning friends that want to help. E.g. you might have an attorney friend that practices business litigation that will help you with probate. This is where you must be cautious and make sure you pick your team of professional experts that will get the job done because this is all they do. Similarly, you might have a realtor friend that specializes in a certain area of town or other type of real estate that wants to list the real estate for you. Again, having a realtor with probate experience that specializes in the area of your real estate location will benefit you and ensure you get the most out of it.

Not collecting paperwork and submitting documents in a timely fashion

Waiting too long to begin the probate process.

As time goes by taxes add up, creditors become pushier and heirs more impatient. Losing a loved one is devastating and moving forward can at times almost seem emotionally impossible. However, waiting too long will add pressure and demands from others to your mourning process. Give yourself time to mourn but also realize that the longer you wait the greater the demands.

Not Keeping Accurate Accounting Records

If you are not comfortable with or not used to accounting and balance sheets, it make sense to enroll a professional such as a book keeper or CPA to help you. At the time of settling the estate all numbers must align and make sense. If not, you might get objections from the heirs or maybe even a judge. In many cases where records were not properly kept, the probate process lasted up to 24 months when it should have taken half that time or less.

Not picking up mail from decedents property

This is a simple one. As soon as you can, ask that the post office forwards all mail to an address or PO Box that you have access to. The reason being, that you may miss out on important notices and claims from creditors and/or lenders. Another good reason is that you do not want the property to be too inviting for burglars or vandalism. When mail piles up, it is a sure sign that the property is vacant.

Not keeping open communication with heirs

This goes back to the initial mistake “No outcome in mind” when you begin the process. At the outset of probate it is crucial that all heirs are on the same page and agree that you handle the estate. Along the way you may have smaller setbacks and it will not go as planned. Make sure you communicate every setback and progress. If an heir counts on his/her inheritance by a certain date based on the agreed upon goal you all set, then any delays will greatly impact the heirs life.

Not knowing your options when it comes to selling real estate

Real Estate is the biggest component of the estate’s assets. Depending upon your desired outcome and goals you should know that you have options in real estate. The basic and straight forward approach is to list with a local realtor. You may also find yourself with real estate that needs some work and could therefore fetch a greater price after some repairs. If you do not have the cash for the repairs, but ample time on your hands, there are people we can refer you to that will gladly partner with you on the

repairs. Finally, if you are in a rush, don’t have cash to fix up the real estate and just want to get done with it; an investor will pay cash for it. Knowing your options gives you flexibility which gives you power in your decision.

Have us Contact You

Why You May Want an Energy-Efficient Home

Why You May Want an Energy-Efficient Home Some Highlights Since inflation is increasing the cost of goods and services, it may make sense to look for an energy-efficient home. Energy prices have increased over the last year, so look for energy-efficient features in...

Why Use A Senior Real Estate Specialist?

Why Use A Senior Real Estate Specialist As we age, our housing needs change. Whether you're looking to downsize, move closer to family, or find a home that better suits your lifestyle, the process of selling your home can be overwhelming. That's where a Senior...

What’s the Difference Between a Home Inspection and an Appraisal?

What’s the Difference Between a Home Inspection and an Appraisal? If you’re planning to buy a home, an inspection is an important step in the process. It assesses the condition of the home before you finalize the transaction. It’s also a different step in the process...

Falling out of Love with Your House? It May Be Time To Move.

Falling out of Love with Your House? It May Be Time To Move. Owning a home means having a place that’s solely your own and provides the space, features, and location you and your loved ones need. But what happens when your needs change? If this hits home for you, it...

98% of millennials want to become a homeowner at some point if they aren’t already.

5 Reasons Millennials Are Buying Homes In the United States, there are over 72 million millennials. If you’re part of that generation and have thought about buying a home, you aren’t alone. According to Zonda, 98% of millennials want to become a homeowner at some...