A mother and her son are hugging in their living room. The mother is wearing a military uniform.

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice.

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational training to home loans.

Facts About VA Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Benefits of a VA Home Loan:

- No down payment

- No Private Mortgage Insurance*

- Lower credit score requirements

- Limitation on closing costs

- Lower average interest rates

*More information on VA Home Loan Fees

Bottom Line

The best thing you can do today to celebrate Veterans Day is to share this information with those who can benefit from these opportunities. For more information, or to find out how to qualify to use a VA Home Loan Benefit, let’s get together to navigate through the process. Thank you for your service!

Now helping navigate the solutions when coping with divorce and Real Property

National Association of Divorce Professionals Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential...

What You Should Know About Closing Costs

What You Should Know About Closing Costs Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when...

How To Win as a Buyer in Today’s Housing Market In Utah

How To Win as a Buyer in Today’s Housing Market Some Highlights In today’s housing market, you can still be the champion if you have the right team and strategy. To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of...

Are We in a Housing Bubble?

The Top Reasons for Selling Your House

The Top Reasons for Selling Your House Many of today’s homeowners bought or refinanced their homes during the pandemic when mortgage rates were at history-making lows. Since rates doubled in 2022, some of those homeowners put their plans to move on hold, not wanting...

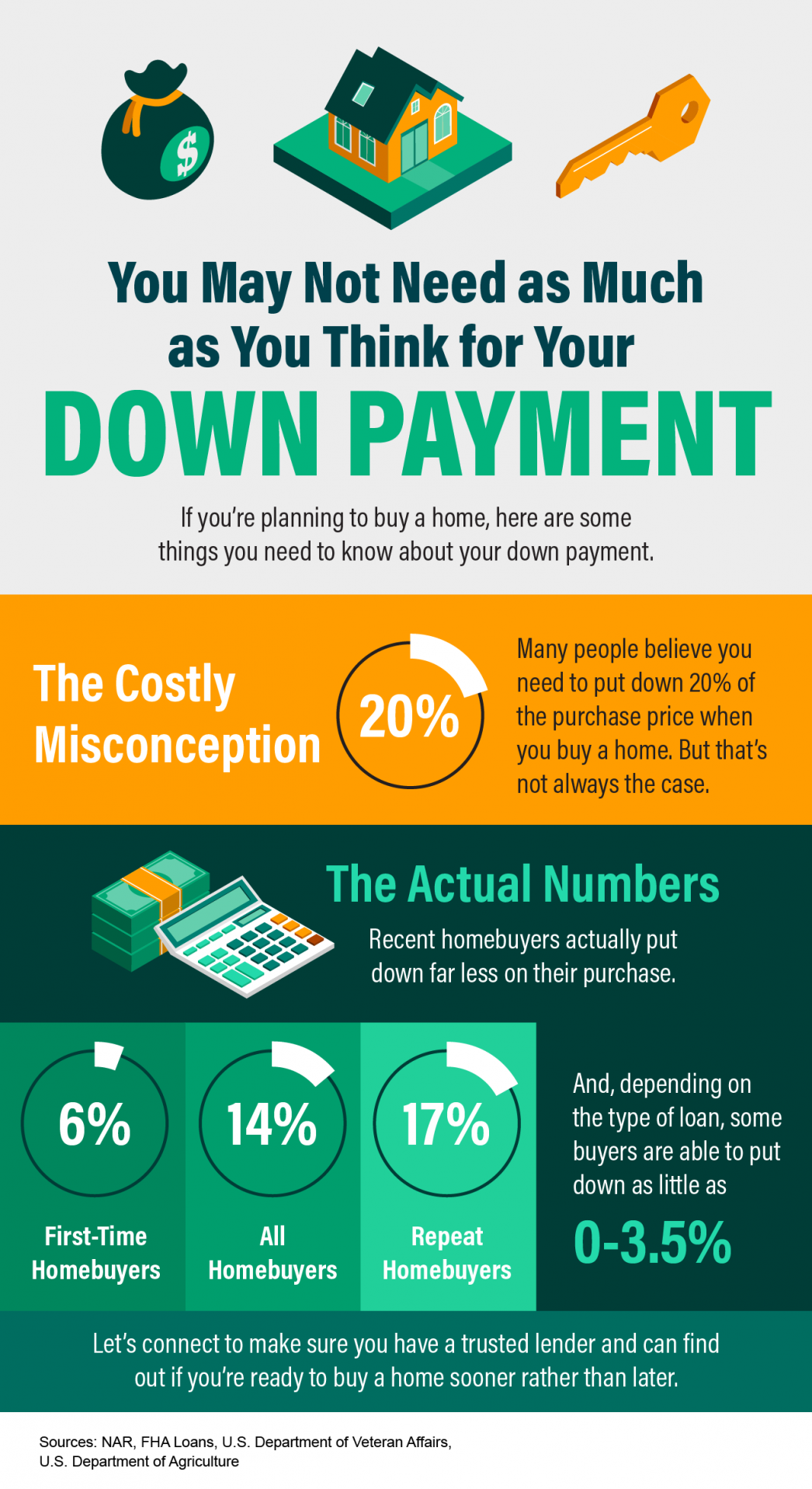

You May Not Need as Much as You Think for Your Down Payment

You May Not Need as Much as You Think for Your Down Payment Some Highlights Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase. And with programs like FHA loans, VA...

Create Your Perfect Home by Perfecting It After You Purchase

Want To Sell Your House? Price It Right.

Want To Sell Your House? Price It Right. Last year, the housing market slowed down in response to higher mortgage rates, and that had an impact on home prices. If you’re thinking of selling your house soon, that means you’ll want to adjust your expectations...

Pre-Approval in 2023: What You Need To Know

Pre-Approval in 2023: What You Need To Know One of the first steps in your homebuying journey is getting pre-approved. To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you. Business Insider explains: “In a...

What Past Recessions Tell Us About the Housing Market

What Past Recessions Tell Us About the Housing Market It doesn’t matter if you’re someone who closely follows the economy or not, chances are you’ve heard whispers of an upcoming recession. Economic conditions are determined by a broad range of factors, so rather than...