Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...

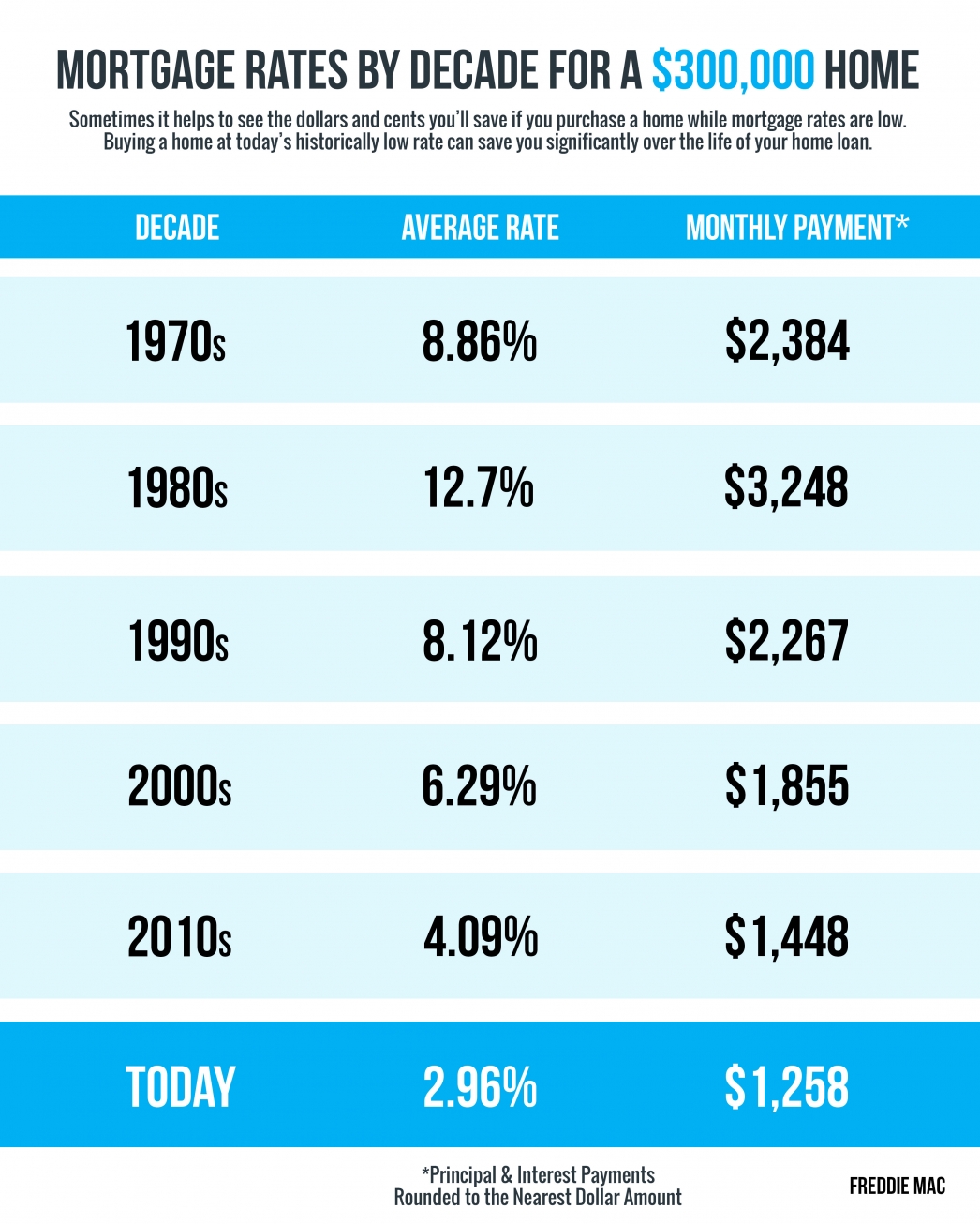

Mortgage Rates and Payments by Each Decade

Mortgage Rates & Payments by DecadeSome HighlightsSometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your...

Housing by the Numbers by Utah Realty

Homes Are More Affordable Right Now Than They Have Been in Years

Homes Are More Affordable Right Now Than They Have Been in YearsToday, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low...

Why Foreclosures Won’t Crush the Housing Market Next Year

Why Foreclosures Won’t Crush the Housing Market Next YearWith the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well...

The Latest Unemployment Report: Slow and Steady Improvement

The Latest Unemployment Report: Slow and Steady ImprovementLast Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the...

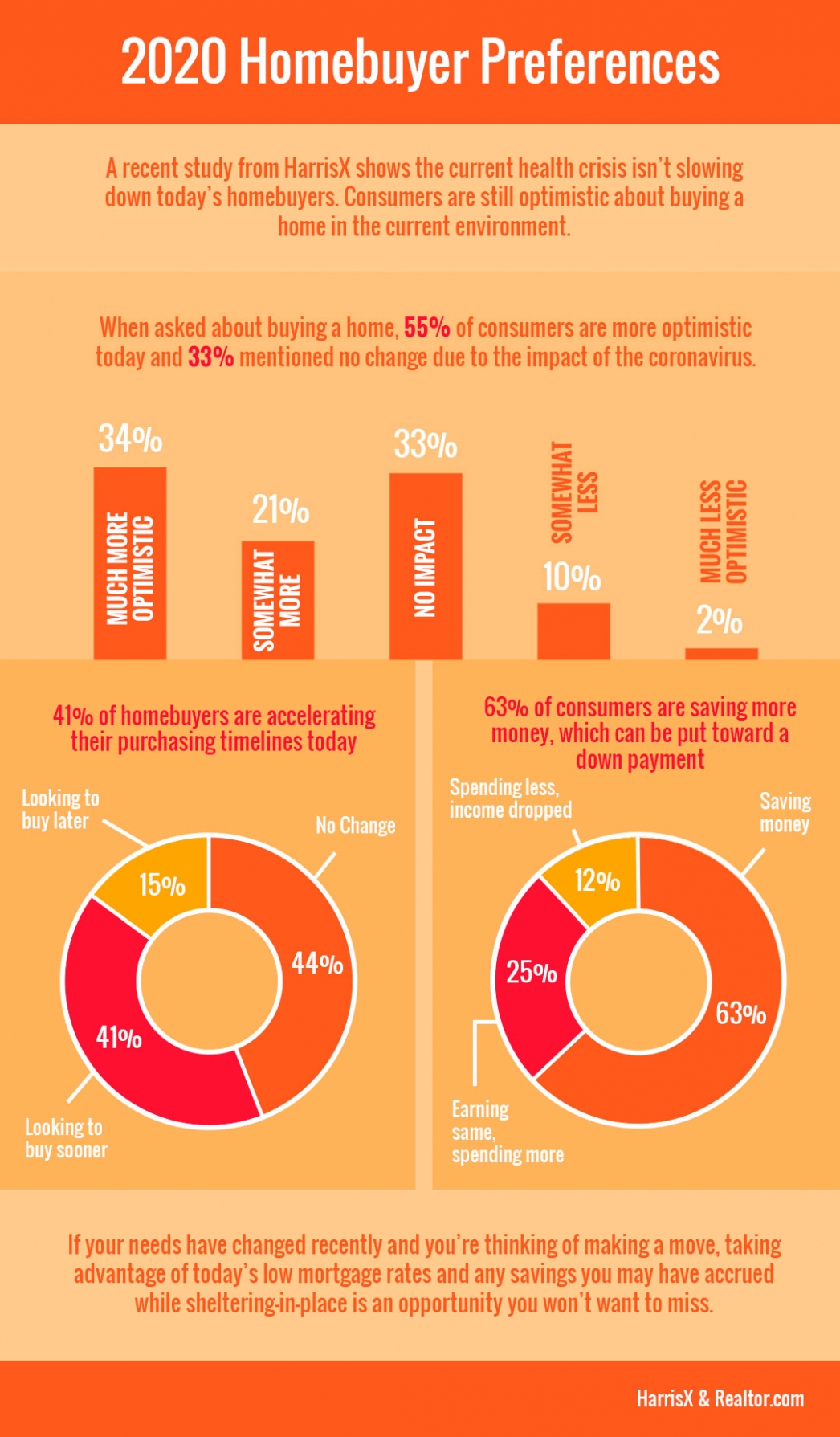

2020 Homebuyer Preferences

2020 Homebuyer PreferencesSome HighlightsA recent study from HarrisX shows the current health crisis isn’t slowing down today’s homebuyers.Many buyers are accelerating their timelines to take advantage of low mortgage rates, and staying home has enabled some to save...

Expert Reactions to the 2020 Housing Market Recovery

America Has a Surprising New Favorite Room in the House

Photo Copyright Marty Gale The family room has long been the favorite room in the house—it’s where homeowners get to spend quality time with other family members. However, as the significant increase in time spent at home during the pandemic has changed preferences,...

How Is Remote Work Changing Homebuyer Needs?

How Is Remote Work Changing Homebuyer Needs?With more companies figuring out how to efficiently and effectively enable their employees to work remotely (and for longer than most of us initially expected), homeowners throughout the country are re-evaluating their...