Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

The Next Generation of Homebuyers Is Here

The Next Generation of Homebuyers Is Here Many members of Generation Z (Gen Z) are aging into adulthood and deciding whether to rent or buy a home. If you find yourself in this group, it’s important to understand you’re never too young to start thinking about...

Why Pre-Approval Is Key for Homebuyers in 2022

Why Pre-Approval Is Key for Homebuyers in 2022 You may have heard that it’s important to get pre-approved for a mortgage at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with...

Buyers Want To Know: Why Is Housing Supply Still So Low?

Buyers Want To Know: Why Is Housing Supply Still So Low? One key question that’s top of mind for homebuyers this year is: why is it so hard to find a house to buy? The truth is, we’re in the ultimate sellers’ market, so real estate is ultra-competitive for buyers...

What Are the Best Tips if You’re Planning To Sell Your House?

Utah Housing Market Stats for December 2021

Utah Housing Market State for December 2021

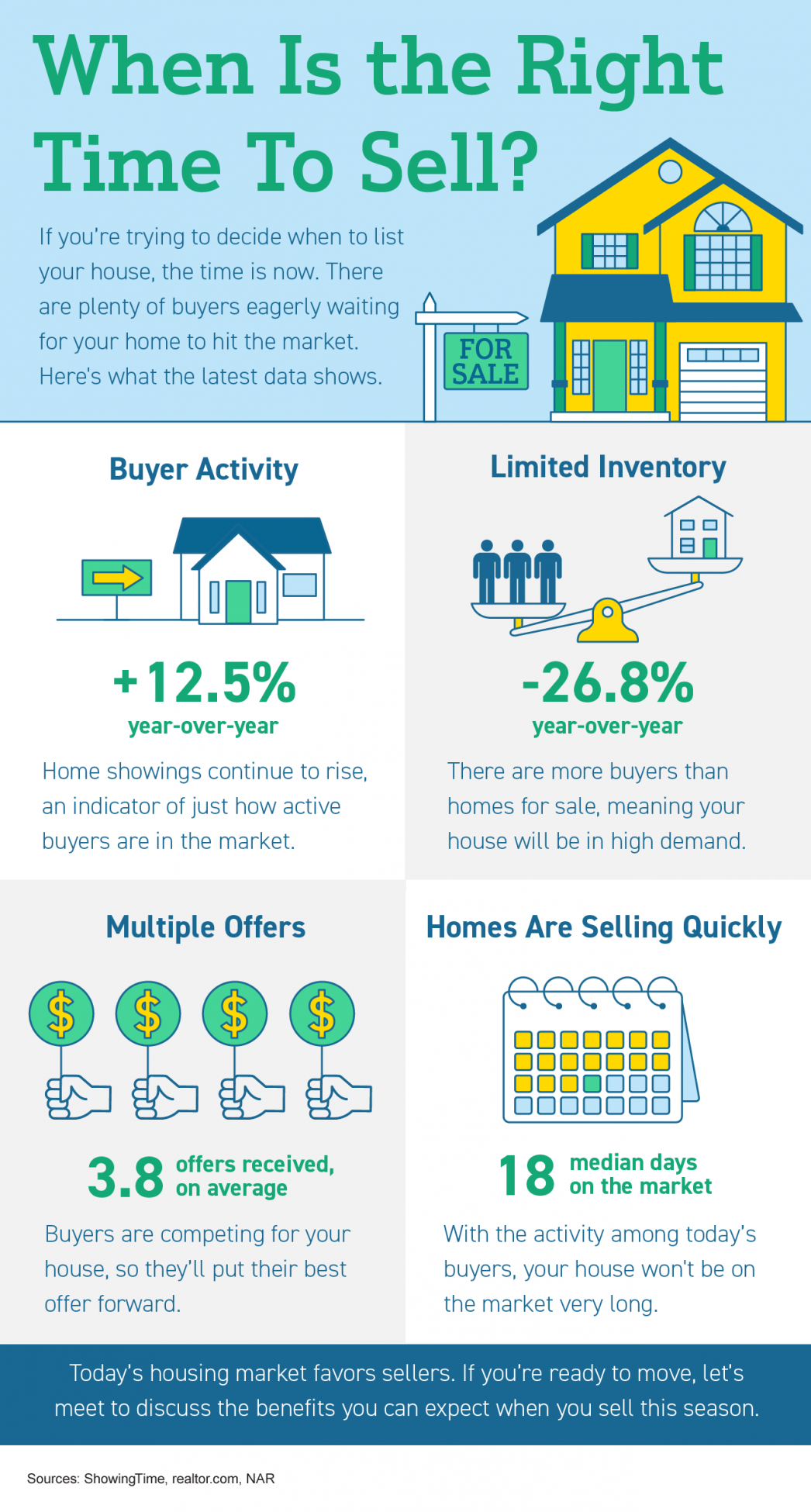

When Is the Right Time To Sell ?

When Is the Right Time To Sell Some Highlights If you’re trying to decide when to list your house, the time is now. There are plenty of buyers eagerly waiting for your home to hit the market. The latest data indicates home...

Why You Shouldn’t Sell Your House on Your Own

Why You Shouldn't Sell Your House on Your Own There's more to selling your house than putting up a For Sale sign....

Expert Insights on the 2022 Housing Market Utah Realty™

Expert Insights on the 2022 Housing Market As we move into 2022, both buyers and sellers are wondering, what’s next? Will there be more homes available to buy? Will prices keep climbing? How high will mortgage rates go? For the answer to those questions and more, we...

Your Best Offer

5 Tips for Making Your Best Offer on a Home As a buyer in a sellers’ market, sometimes it can feel like you’re stuck between a rock and a hard place. When you’re ready to make an offer on a home, remember these five easy tips to help you rise above the competition. 1....

Merry Christmas! Happy New Year! Thank You for All of Your Support

Merry Christmas! Happy New Year! Thank You for All of Your Support