Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

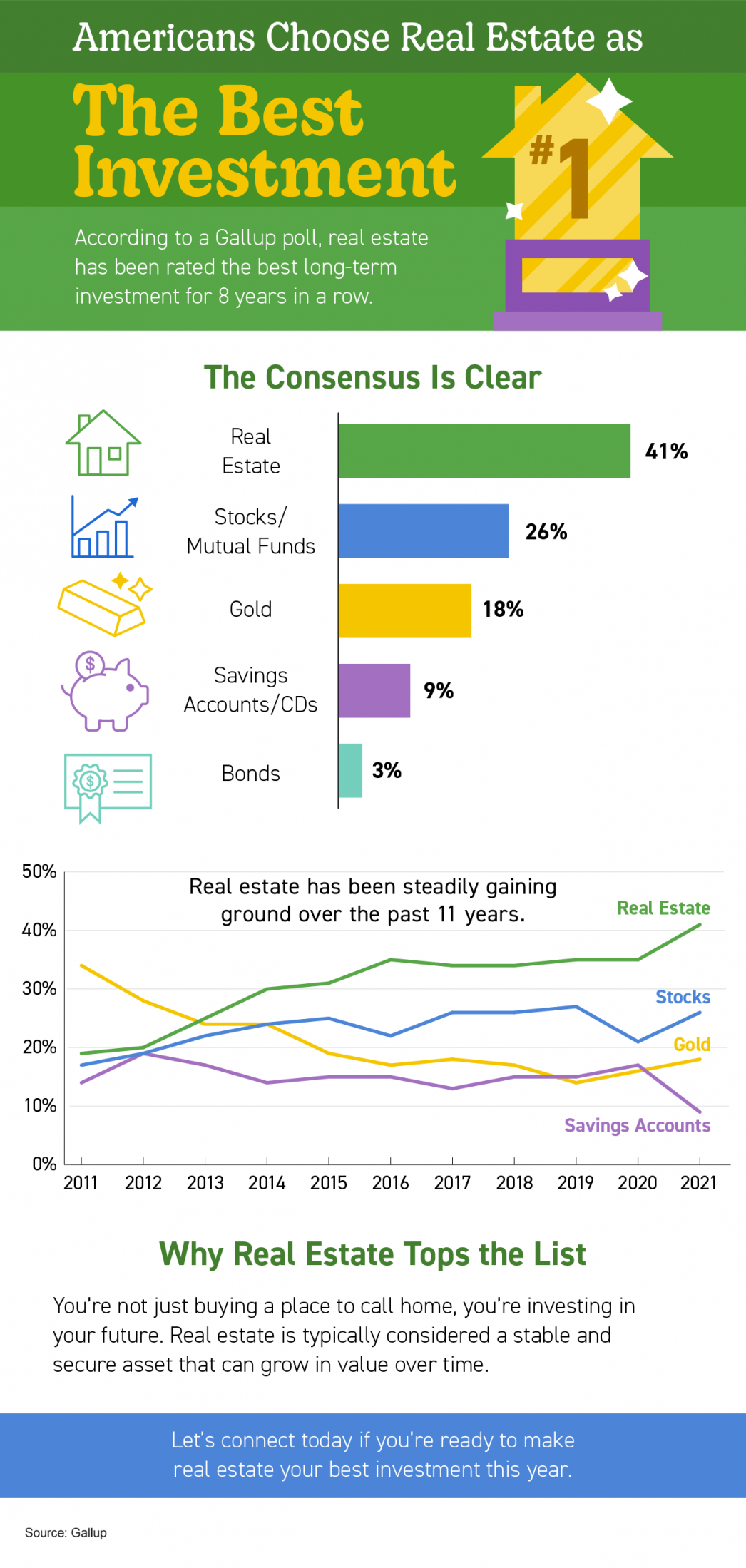

Americans Choose Real Estate as the Best Investment

Americans Choose Real Estate as the Best Investment Some Highlights According to a Gallup poll, real estate has been rated the best long-term investment for eight years in a row. Real estate tops the list because you’re not just buying a place to call home – you’re...

The Next Generation of Homebuyers Is Here

The Next Generation of Homebuyers Is Here Many members of Generation Z (Gen Z) are aging into adulthood and deciding whether to rent or buy a home. If you find yourself in this group, it’s important to understand you’re never too young to start thinking about...

Why Pre-Approval Is Key for Homebuyers in 2022

Why Pre-Approval Is Key for Homebuyers in 2022 You may have heard that it’s important to get pre-approved for a mortgage at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with...

Buyers Want To Know: Why Is Housing Supply Still So Low?

Buyers Want To Know: Why Is Housing Supply Still So Low? One key question that’s top of mind for homebuyers this year is: why is it so hard to find a house to buy? The truth is, we’re in the ultimate sellers’ market, so real estate is ultra-competitive for buyers...

What Are the Best Tips if You’re Planning To Sell Your House?

Utah Housing Market Stats for December 2021

Utah Housing Market State for December 2021

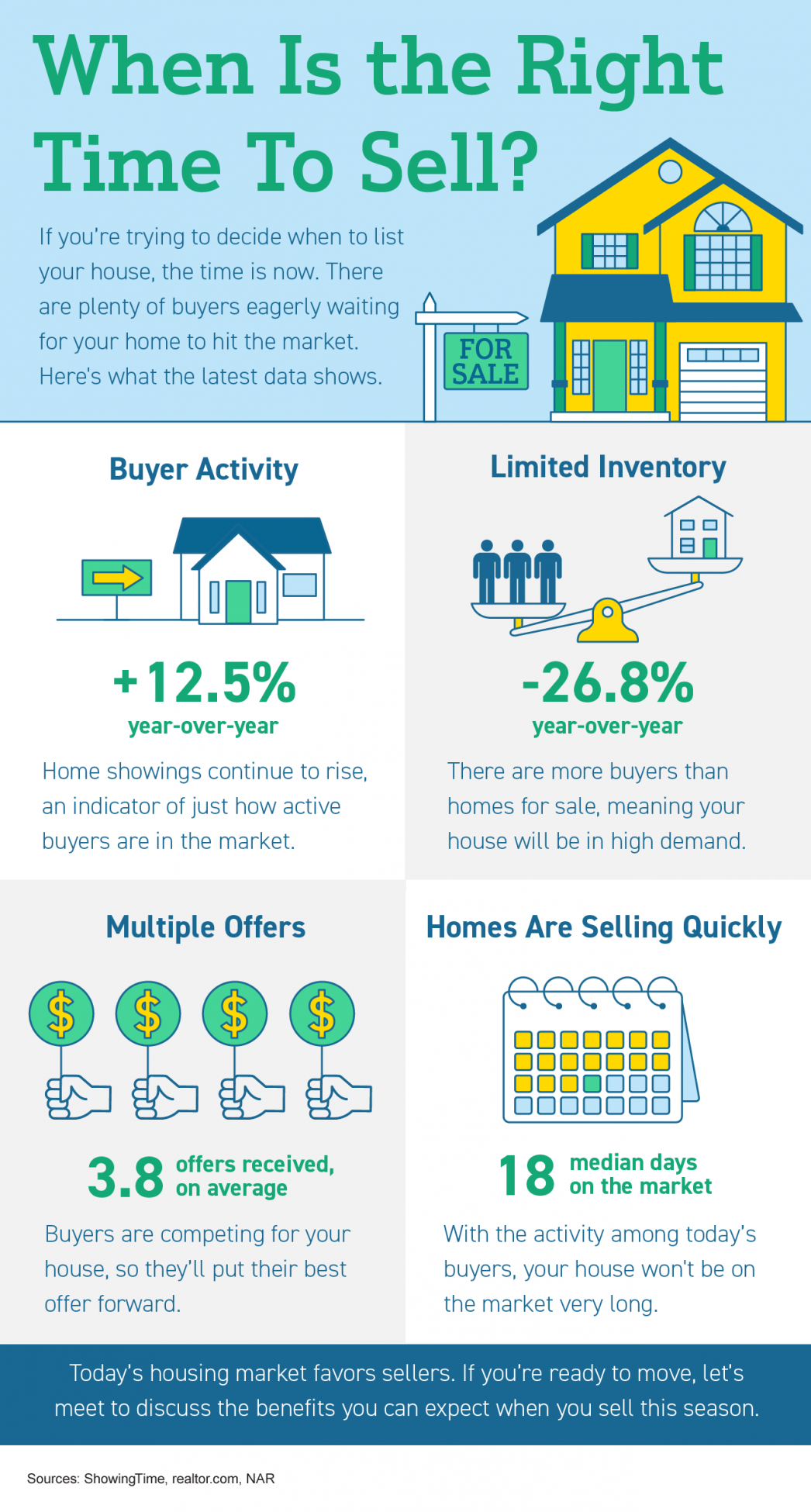

When Is the Right Time To Sell ?

When Is the Right Time To Sell Some Highlights If you’re trying to decide when to list your house, the time is now. There are plenty of buyers eagerly waiting for your home to hit the market. The latest data indicates home...

Why You Shouldn’t Sell Your House on Your Own

Why You Shouldn't Sell Your House on Your Own There's more to selling your house than putting up a For Sale sign....

Expert Insights on the 2022 Housing Market Utah Realty™

Expert Insights on the 2022 Housing Market As we move into 2022, both buyers and sellers are wondering, what’s next? Will there be more homes available to buy? Will prices keep climbing? How high will mortgage rates go? For the answer to those questions and more, we...

Your Best Offer

5 Tips for Making Your Best Offer on a Home As a buyer in a sellers’ market, sometimes it can feel like you’re stuck between a rock and a hard place. When you’re ready to make an offer on a home, remember these five easy tips to help you rise above the competition. 1....