Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

How To Win as a Buyer in Today’s Housing Market In Utah

How To Win as a Buyer in Today’s Housing Market Some Highlights In today’s housing market, you can still be the champion if you have the right team and strategy. To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of...

Are We in a Housing Bubble?

The Top Reasons for Selling Your House

The Top Reasons for Selling Your House Many of today’s homeowners bought or refinanced their homes during the pandemic when mortgage rates were at history-making lows. Since rates doubled in 2022, some of those homeowners put their plans to move on hold, not wanting...

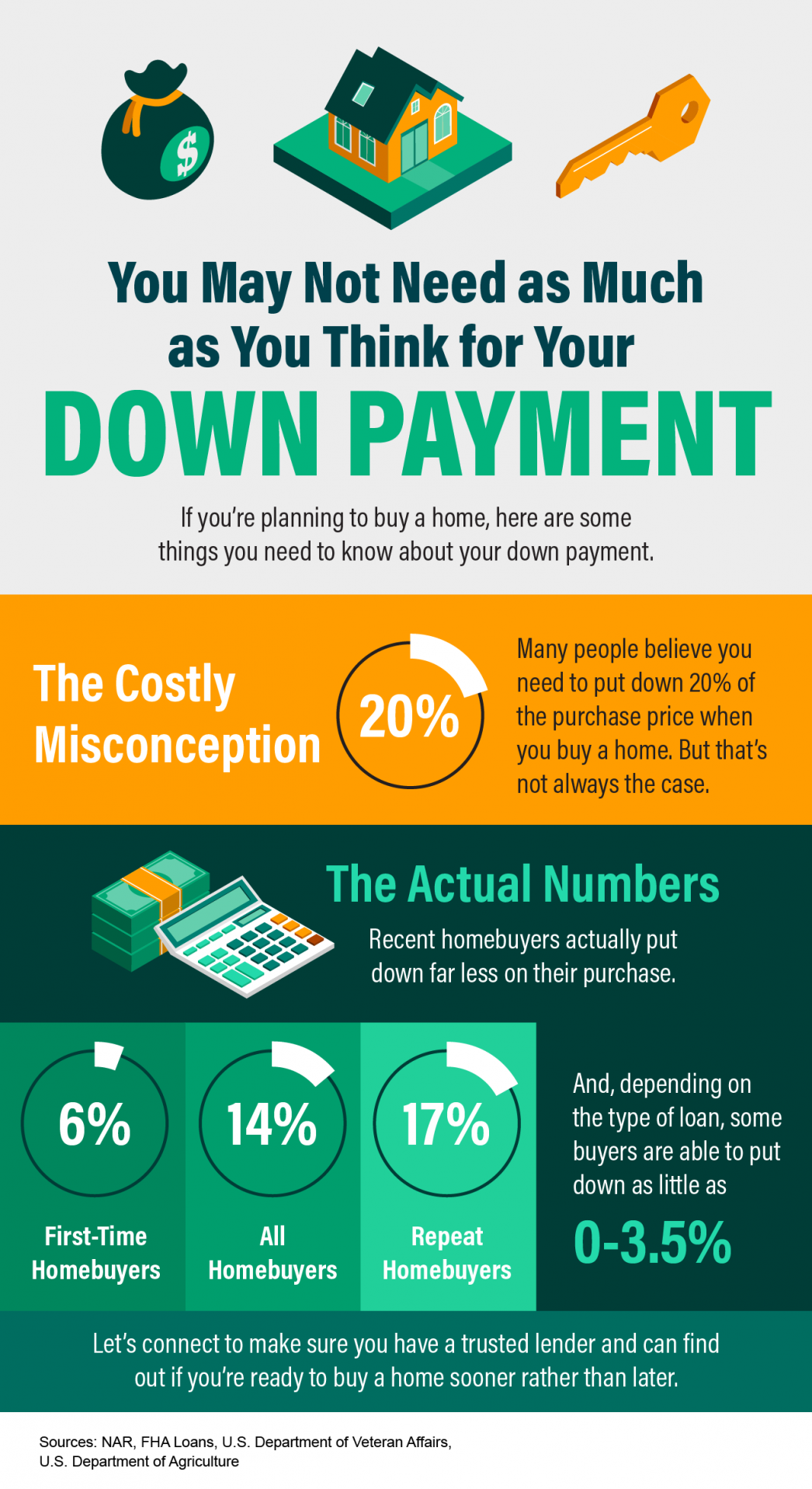

You May Not Need as Much as You Think for Your Down Payment

You May Not Need as Much as You Think for Your Down Payment Some Highlights Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase. And with programs like FHA loans, VA...

Create Your Perfect Home by Perfecting It After You Purchase

Want To Sell Your House? Price It Right.

Want To Sell Your House? Price It Right. Last year, the housing market slowed down in response to higher mortgage rates, and that had an impact on home prices. If you’re thinking of selling your house soon, that means you’ll want to adjust your expectations...

Pre-Approval in 2023: What You Need To Know

Pre-Approval in 2023: What You Need To Know One of the first steps in your homebuying journey is getting pre-approved. To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you. Business Insider explains: “In a...

What Past Recessions Tell Us About the Housing Market

What Past Recessions Tell Us About the Housing Market It doesn’t matter if you’re someone who closely follows the economy or not, chances are you’ve heard whispers of an upcoming recession. Economic conditions are determined by a broad range of factors, so rather than...

Is It Time To Sell Your Second Home?

Is It Time To Sell Your Second Home? During the pandemic, second homes became popular because of the rise in work-from-home flexibility. That’s because owning a second home, especially in the luxury market, allowed those homeowners to spend more time in their favorite...

Today’s Housing Market Is Nothing Like 15 Years Ago

Today’s Housing Market Is Nothing Like 15 Years Ago There’s no doubt today’s housing market is very different than the frenzied one from the past couple of years. In the second half of 2022, there was a dramatic shift in real estate, and it caused many people to make...