How To List Your Home for the Best Price

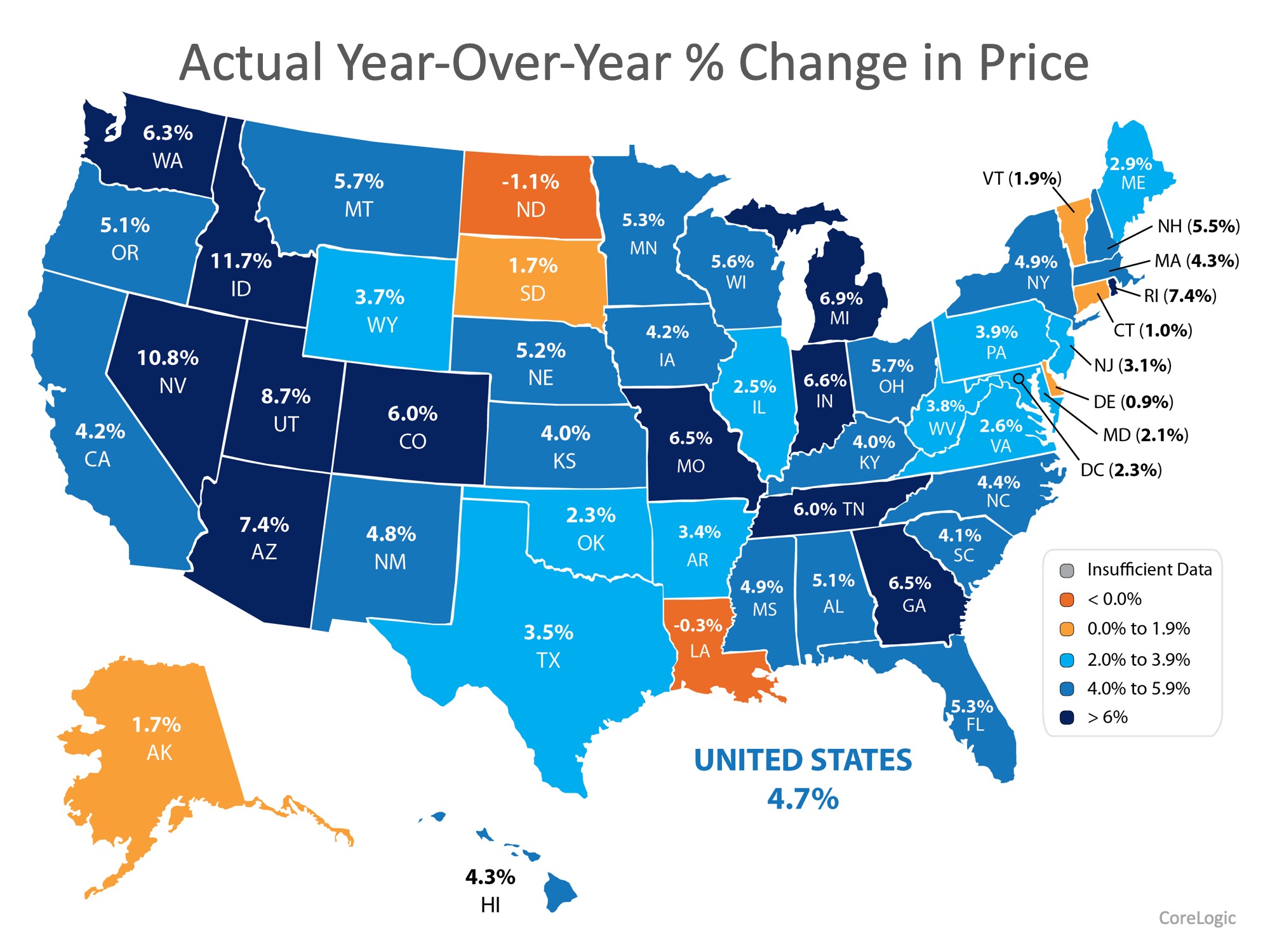

If your plan for 2019 includes selling your home, you will want to pay attention to where experts believe home values are headed. According to the latest Home Price Index from CoreLogic, home prices increased by 4.7% over the course of 2018.

The map below shows the results of the latest index by state.

Real estate is local. Each state appreciates at different levels. The majority of the country saw at least a 2.0% gain in home values, while some residents in North Dakota and Louisiana may have felt prices slow slightly.

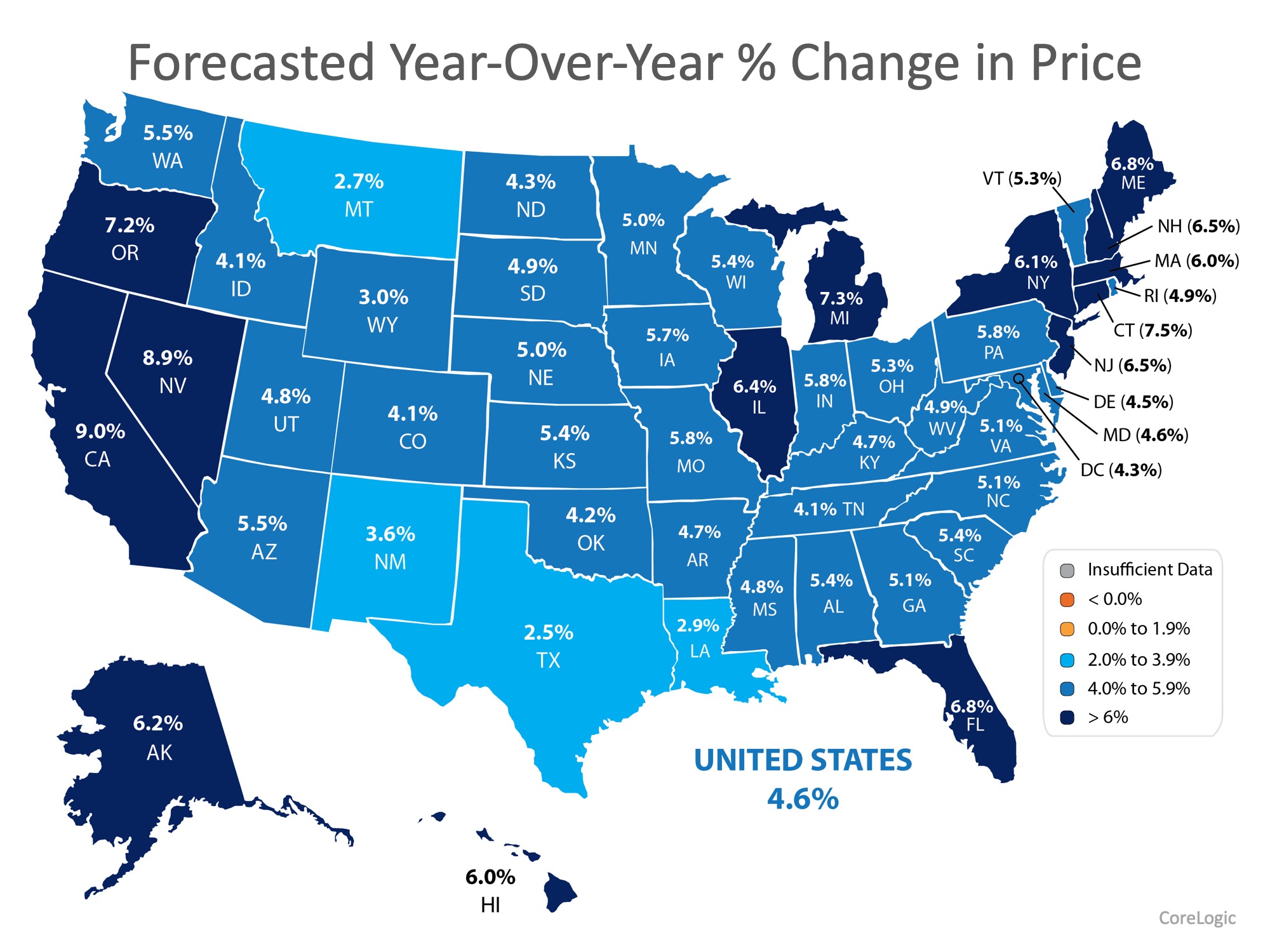

This effect will be short lived. In the same report, CoreLogic forecasts that every state in the Union will experience at least 2.0% appreciation, with the majority of the country gaining at least 4.0%! The prediction for the country comes in at 4.6%. For a median-priced home, that translates to over $14,000 in additional equity next year! (The map below shows the forecast by state.)

So, how does this help you list your home for the best price?

Armed with the knowledge of how much experts believe your house will appreciate this year, you will be able to set an appropriate price for your listing from the start. If homes like yours are appreciating at 4.0%, you won’t want to list your home for more than that amount!

One of the biggest mistakes homeowners make is pricing their homes too high and reducing the price later when they do not get any offers. This can lead buyers to believe that there may be something wrong with the home, when in fact the price was just too high for the market.

Bottom Line

Pricing your home right from the start is one of the most challenging parts of selling your home. Once you decide to list your house, let’s get together to discuss where home values are headed in your area!

Is It Time To Sell Your Second Home?

Is It Time To Sell Your Second Home? During the pandemic, second homes became popular because of the rise in work-from-home flexibility. That’s because owning a second home, especially in the luxury market, allowed those homeowners to spend more time in their favorite...

Today’s Housing Market Is Nothing Like 15 Years Ago

Today’s Housing Market Is Nothing Like 15 Years Ago There’s no doubt today’s housing market is very different than the frenzied one from the past couple of years. In the second half of 2022, there was a dramatic shift in real estate, and it caused many people to make...

What Experts Are Saying About the 2023 Housing Market

What Experts Are Saying About the 2023 Housing Market If you’re thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market this year. In 2022, the market underwent a major shift as economic uncertainty and...

Tips To Reach Your Homebuying Goals in 2023

Tips To Reach Your Homebuying Goals in 2023 Some Highlights If you’re planning to buy a home in 2023, here are a few things to focus on. Work on your credit and save for a down payment. If saving feels like a challenge, there’s help available. Then, get pre-approved,...

3 Best Practices for Selling Your House This Year

3 Best Practices for Selling Your House This Year A new year brings with it the opportunity for new experiences. If that resonates with you because you’re considering making a move, you’re likely juggling a mix of excitement over your next home and a sense of...

Avoid the Rental Trap in 2023

Avoid the Rental Trap in 2023 If you’re a renter, you likely face an important decision every year: renew your current lease, start a new one, or buy a home. This year is no different. But before you dive too deeply into your options, it helps to understand the true...

Planning To Sell Your House? It’s Critical To Hire a Pro

Planning To Sell Your House? It’s Critical To Hire a Pro. With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you’re thinking of selling your house, it’s important to understand how the market has...

Applying For a Mortgage? Here’s What You Should Avoid Once You Do.

Applying For a Mortgage? Here’s What You Should Avoid Once You Do. While it’s exciting to start thinking about moving in and decorating after you’ve applied for your mortgage, there are some key things to keep in mind before you close. Here’s a list of things you may...

Financial Fundamentals for First-Time Homebuyers Are you prepping to buy your first home? If so, one of the steps you should take early on is making sure you’re financially ready for your purchase. Here are just a few of the financial fundamentals you’ll need to focus...

Utah Realty Marty & Laurie Gale

Thank You for All of Your Support