The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

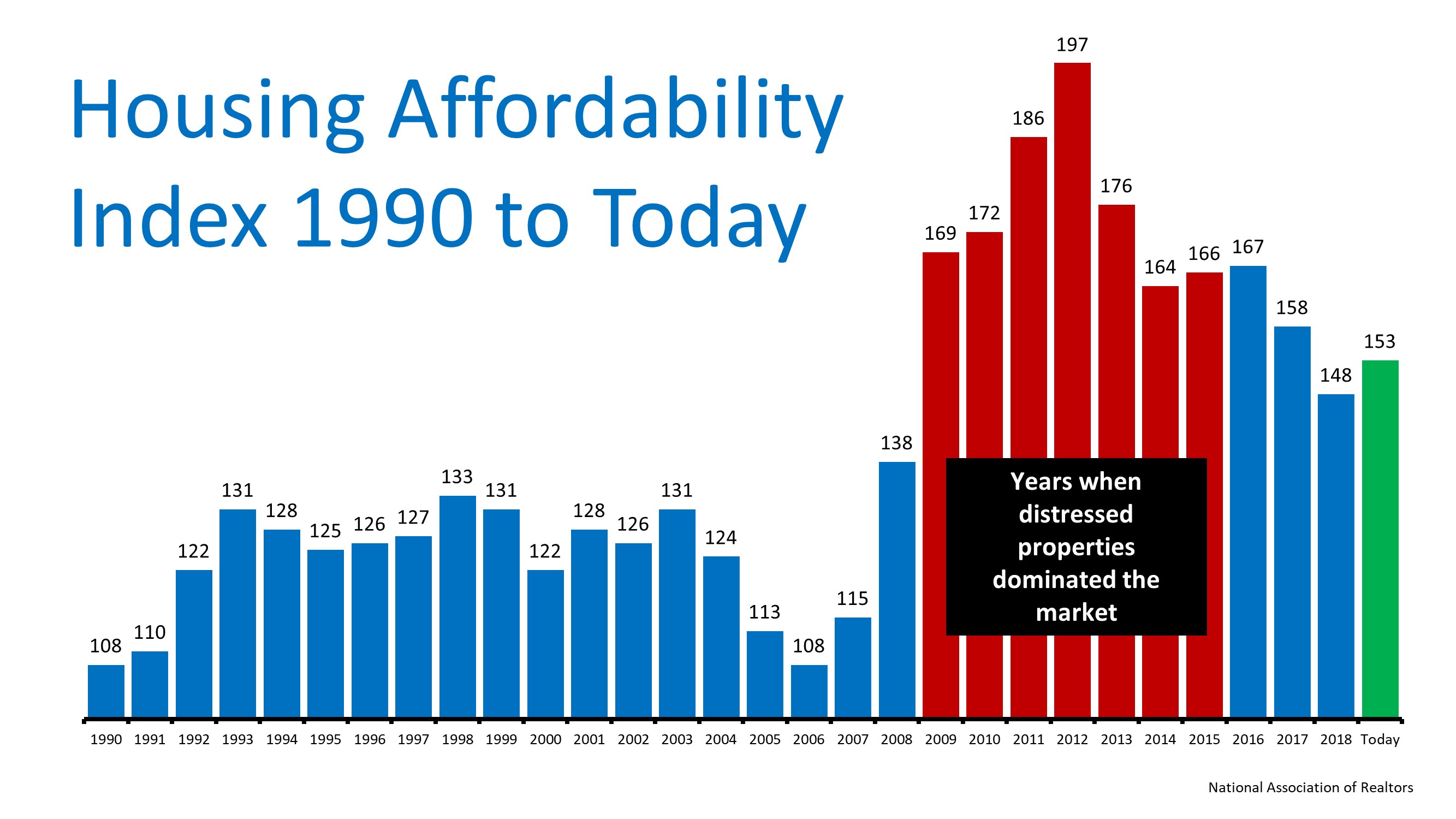

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

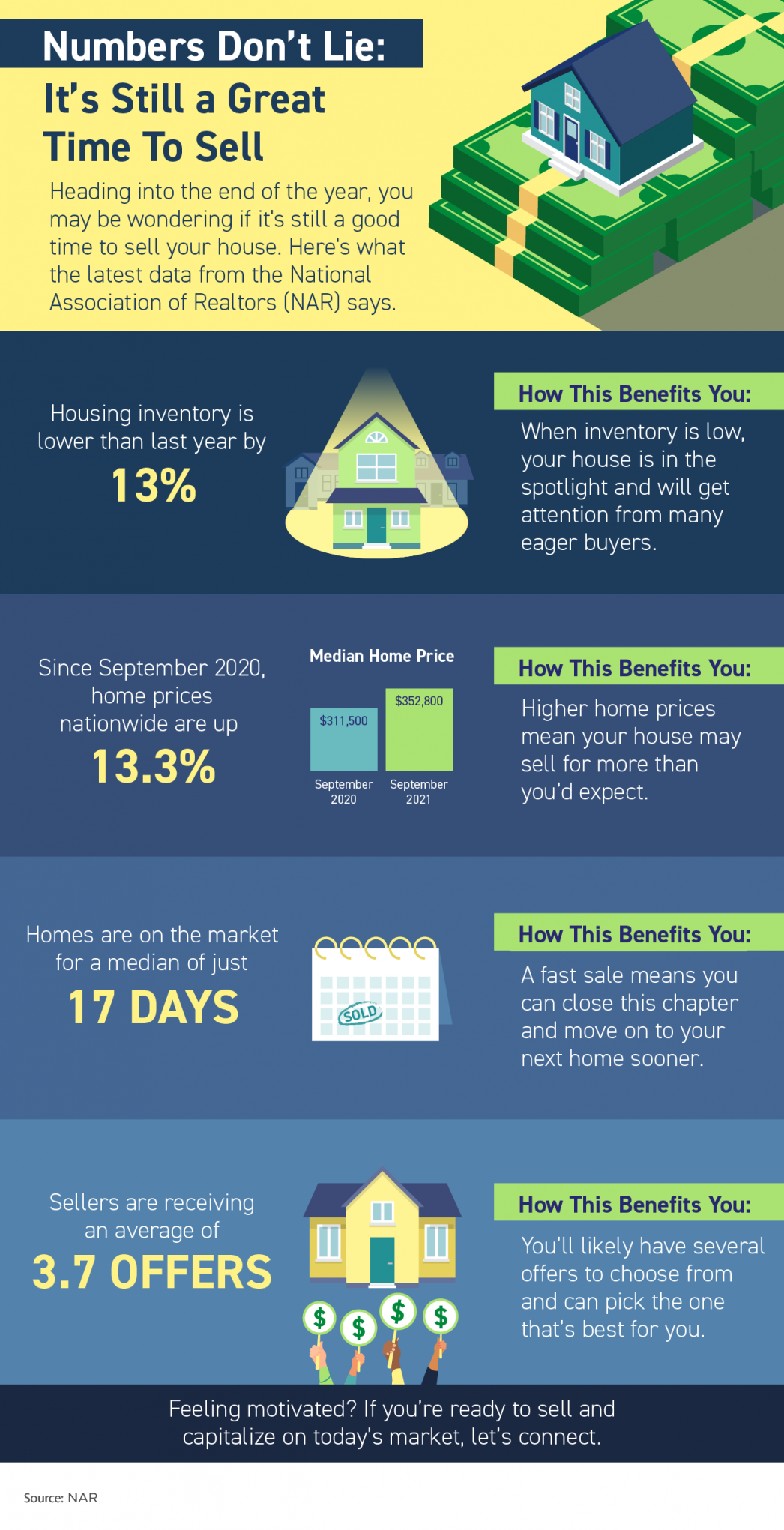

Numbers Don’t Lie – It’s Still a Great Time To Sell

Numbers Don’t Lie – It’s Still a Great Time To Sell Some Highlights Heading into the end of the year, you might wonder if it’s still a good time to sell your house. Here’s what the latest data from the National Association of Realtors (NAR) says. Housing supply is...

Experts Project Mortgage Rates Will Continue To Rise in 2022

Experts Project Mortgage Rates Will Continue To Rise in 2022 Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates...

Sellers Have Incredible Leverage in Today’s Market

Sellers Have Incredible Leverage in Today’s Market With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of...

The Mortgage Process Doesn’t Have To Be Scary

The Mortgage Process Doesn’t Have To Be Scary Some Highlights Applying for a mortgage is a big step towards homeownership, but it doesn’t need to be one you fear. Here are some tips to help you prepare. Know your credit score and work to build strong credit. When...

Housing Challenge or Housing Opportunity? It Depends.

Housing Challenge or Housing Opportunity? It Depends. The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced...

There Are More Homes Available Now than There Were This Spring

There Are More Homes Available Now than There Were This Spring There’s a lot of talk lately about how challenging it can be to find a home to buy. While housing inventory is still low, there are a few important things to understand about the supply of homes for sale...

Knowledge Is Power When It Comes to Appraisals and Inspections

Knowledge Is Power When It Comes to Appraisals and Inspections Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and...

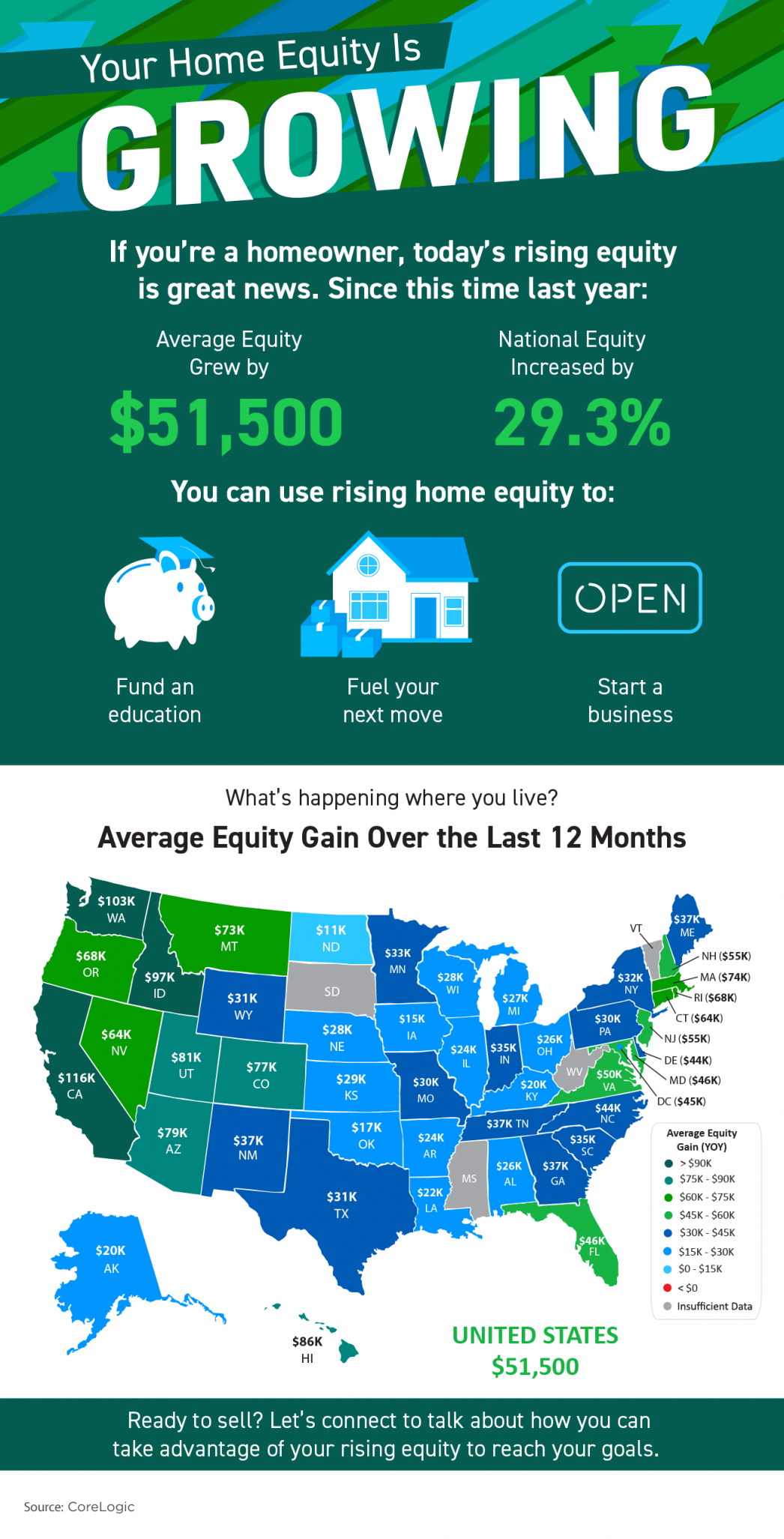

Your Home Equity Is Growing

Your Home Equity Is Growing Some Highlights If you’re a homeowner, today’s rising equity is great news. On average, homeowners have gained $51,500 in equity since this time last year. Whether it’s funding an education, fueling your next move, or starting a business,...

Important Distinction: Homes Are Less Affordable, Not Unaffordable

Important Distinction: Homes Are Less Affordable, Not Unaffordable It’s impossible to research the subject of buying a home without coming across a headline declaring that the fall in home affordability is a crisis. However, when we add context to the most recent...

Perfect Combination

In today’s housing market, houses are selling quickly and are receiving multiple offers from eager buyers. That combination means it’s a great time to sell. DM me so we can discuss how your house plus today’s sellers’ market adds up to a great opportunity for you this...