Hot Sellers Market is Cooling of as Fall Approaches

Stats are for April, May, and June of 2018

Secong Quarter of 2018 (April-June)

Secong Quarter of 2018 (April-June)

An article in Realtor Magazine.

The fall season is cooling down more than the temperature outside; it’s also putting a much-needed chill on hot housing markets, where home prices have become unaffordable to the average buyer. More than one in four home sellers dropped their asking price last month, according to a new report by real estate brokerage Redfin. With inventory starting to inch up, sellers are facing stiffer competition in the market and adjusting their price expectations, according to the report.

Nearly 27 percent of homes that were listed in the four weeks ending Sept. 16 saw a price drop, according to the report. Redfin defines a price drop as a reduction in the home’s value between 1 percent and 50 percent. The areas seeing some of the biggest price drops year over year are Las Vegas; San Jose, Calif.; Seattle; Atlanta.

“After years of strong price growth and intense competition for homes, buyers are taking advantage of the market’s easing pressure by being selective about which homes to make an offer on and how high to bid,” says Redfin Senior Economist Taylor Marr. “But there are some early signs of a softening market, and the increase in price drops may be another indicator that sellers are going to have trouble getting the prices—and the bidding wars—that they may have just months ago. Instead, many are finding their homes are sitting on the market without much interest until they start reducing their prices.”

Courtesy of Realtor Magazine

Why the Price of Your House Matters When Selling

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY...

Home Prices Forecast To Climb over the Next 5 Years

Home Prices Forecast To Climb over the Next 5 Years Some Highlights If you’re worried about what’s next for home prices, know the HPES shows experts are projecting they’ll continue to rise at least through 2028. Based on that forecast, if you bought a $400,000 house...

The Dramatic Impact of Homeownership on Net Worth

The Dramatic Impact of Homeownership on Net Worth If you're trying to decide whether to rent or buy a home this year, here's a powerful insight that could give you the clarity and confidence you need to make your decision. Every three years, the Federal...

Avoid These Common Mistakes After Applying for a Mortgage

Avoid These Common Mistakes After Applying for a Mortgage If you’re getting ready to buy a home, it’s exciting to jump a few steps ahead and think about moving in and making it your own. But before you get too far down the emotional path, there are some key things to...

What are your Goals for 2024?

What are your Goals for 2024?

What Lower Mortgage Rates Mean for Your Purchasing Power

What Lower Mortgage Rates Mean for Your Purchasing Power If you want to buy a home, it's important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly...

Achieving Your Homebuying Dreams in 2024

Achieving Your Homebuying Dreams in 2024 [INFOGRAPHIC] Some Highlights Planning to buy a home in 2024? Here’s what to focus on. Improve your credit score, plan for your down payment, get pre-approved, and decide what’s most important to you. Let’s connect so you have...

Why Pre-Approval Is Your Homebuying Game Changer

Why Pre-Approval Is Your Homebuying Game Changer If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip. So, before you start picturing yourself in your new living room or dining on your future...

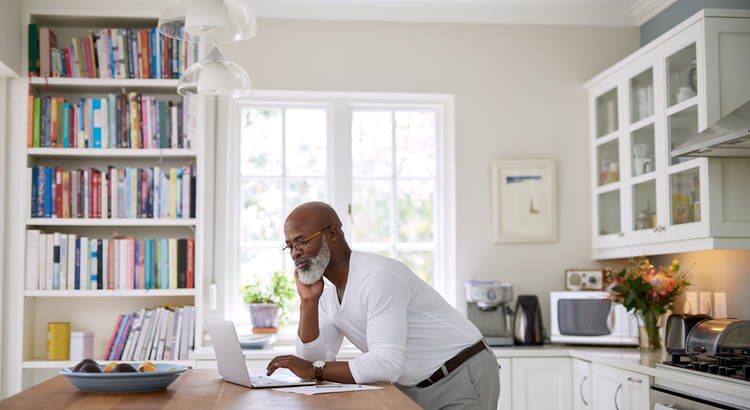

Thinking About Buying a Home? Ask Yourself These Questions

Thinking About Buying a Home? Ask Yourself These Questions If you’re thinking of buying a home this year, you’re probably paying closer attention than normal to the housing market. And you’re getting your information from a variety of channels: the news, social media,...

Things To Consider If Your House Didn’t Sell

Things To Consider If Your House Didn’t Sell If your listing has expired and your house didn’t sell, it's completely normal to feel a mix of frustration and disappointment. Understandably, you're probably wondering what may have gone wrong. Here are three questions to...