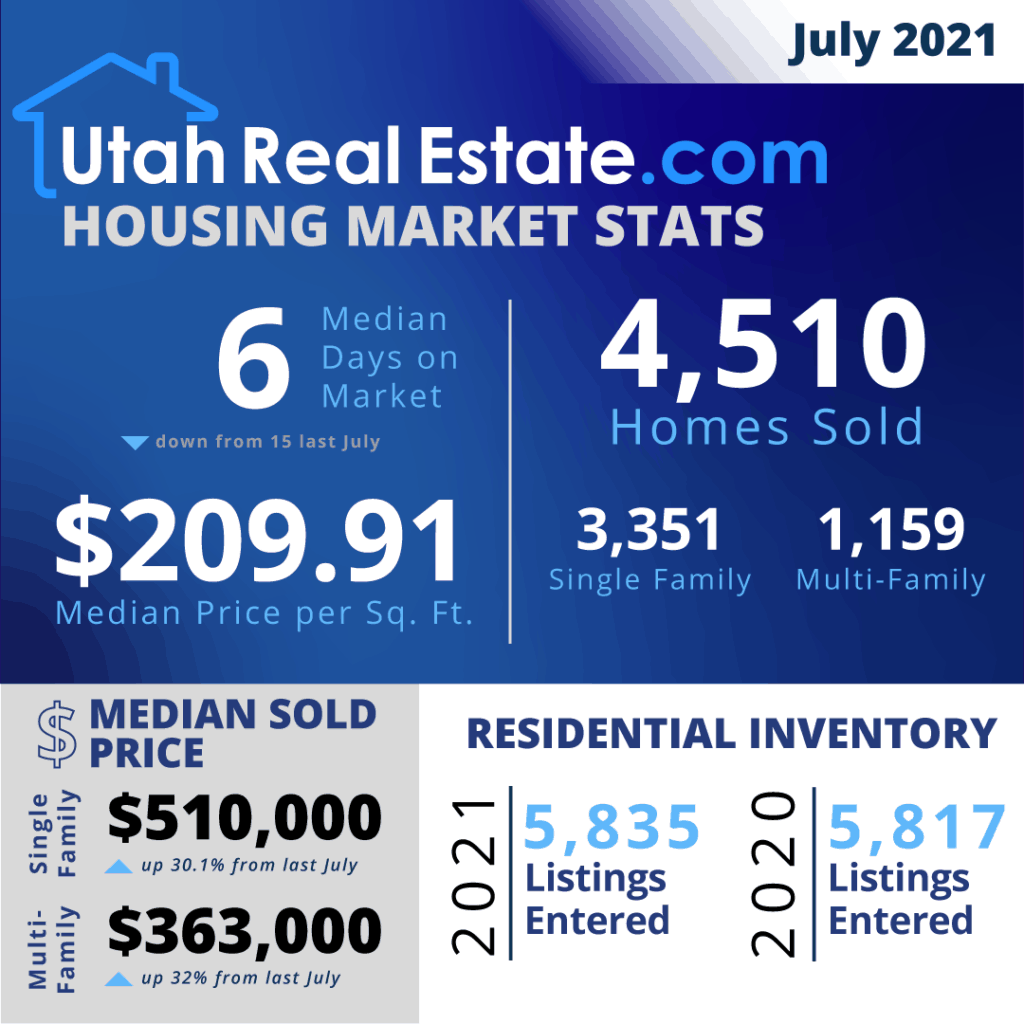

Utah Real Estate Housing Stats

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off a robust housing market in the first half of 2021, but what does the forecast tell us about what’s on the horizon?

Many experts are projecting a rise in interest rates. The latest Quarterly Forecast from Freddie Mac states:

“We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.”

However, even as mortgage rates rise, the anticipated increase is expected to be modest at most, and still well below historical averages. Rates remaining low is good news for homebuyers who are looking to maximize their purchasing power. The same report from Freddie Mac goes on to say:

“While higher mortgage rates will help slow the pace of home sales and moderate house price growth, we expect overall housing market activity will remain robust. Our forecast has total home sales, the sum of new and existing home sales, at 7.1 million in 2021….”

Joe Seydl, Senior Markets Economist at J.P. Morgan, projects home prices to continue rising as well, indicating buyers interested in purchasing a home should do so sooner rather than later. Waiting for rates or home prices to fall may not be wise:

“Homebuyers—interest rates are still historically low, though they are inching up. Housing prices have spiked during the last six-to-nine months, but we don’t expect them to fall soon, and we believe they are more likely to keep rising. If you are looking to purchase a new home, conditions now may be better than 12 months hence.”

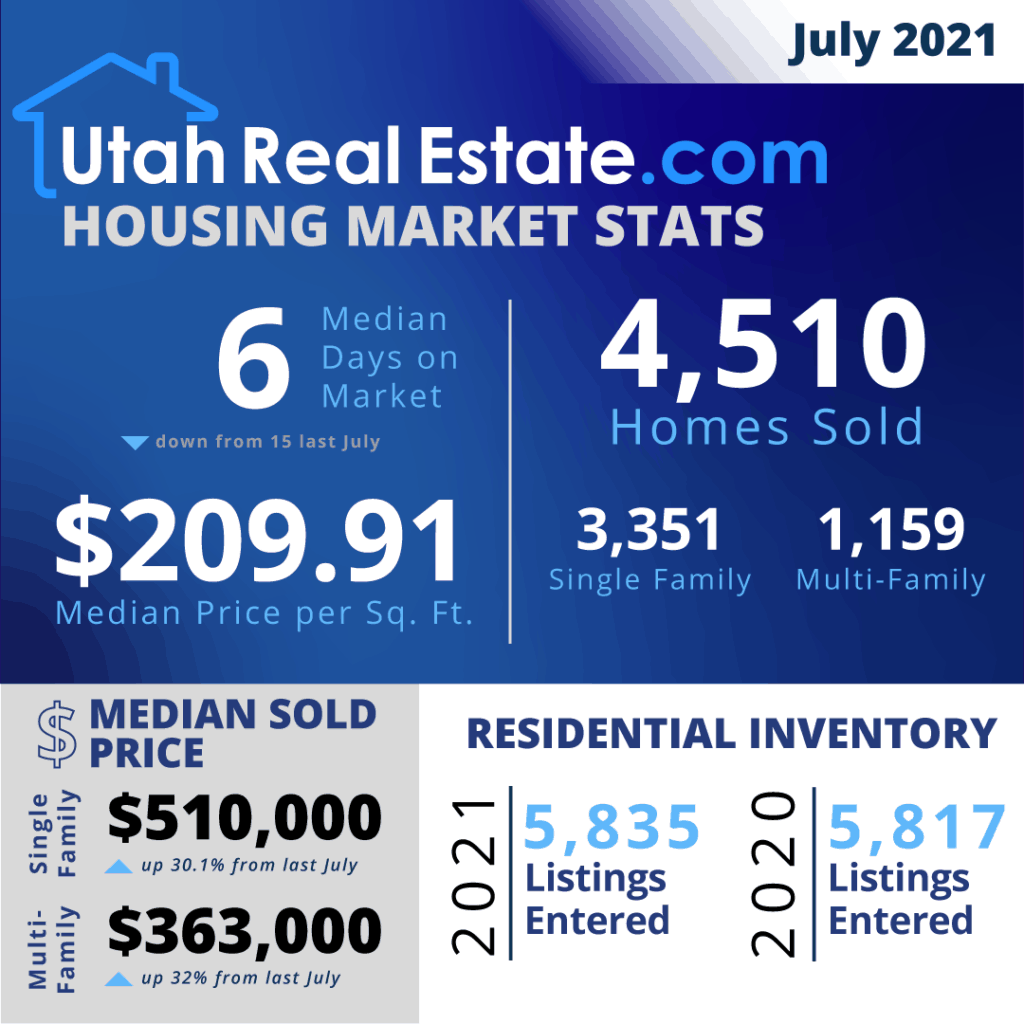

Other experts remain optimistic about home prices, too. The graph below highlights 2021 home price forecasts from multiple industry leaders:

Home prices are rising, but they should moderate as more housing inventory comes to market. George Ratiu, Senior Economist at realtor.com, notes there are signs that we may see the current inventory challenges lessen, slowing the fast-paced home price appreciation and creating more choices for buyers:

“We have seen more new listings this year compared with 2020 in 11 of the last 13 weeks. The influx of new sellers over the last couple of months has been especially helpful in slowing price gains.”

New home starts are also showing signs of improvement, which further bolsters hopes of more options coming to market. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), writes:

“As an indicator of the economic impact of housing, there are now 652,000 single-family homes under construction. This is 28% higher than a year ago.”

Finally, while it may not fundamentally change the market conditions we’re currently experiencing, another reason to be optimistic more homes might come to market: our improving economy. Mark Fleming, Chief Economist at First American, notes:

“A growing economy in the summer months has multiple implications for the housing market. Growing consumer confidence, a stronger labor market, and higher wages bode well for housing demand. While a growing economy and improving public health conditions may also spur hesitant existing owners to list their homes for sale, it’s unlikely to significantly ease the super sellers’ market conditions.”

As we look at the forecast for prices, interest rates, inventory, and home sales, experts remain optimistic about what’s on the horizon for the second half of 2021. Let’s connect today to discuss how we can navigate the market together in the coming months.

Some people say that when the market is hot, “I can sell my home myself,” or “I don’t need an experienced agent because it costs money,” or “how hard can it be?”

Curtis Bullock From the Salt Lake Board of Realtors® Writes

I can tell you that after being an attorney in this industry for almost two decades, there are no “easy” transactions in real estate right now – even in this hot seller’s market. Selling or purchasing a home requires a unique skill set and knowledge base to ensure the transaction goes smoothly. If you have recently purchased or sold a home and felt like it was easy, it’s probably because your Realtor® was solving problems left and right behind the scenes without you knowing about it.

I’ve shared this before, but here is a list of potential trouble spots your Realtor® will help you avoid when purchasing or selling a home. I’ve seen most of these happen when a seller or buyer tries DIY’ing the purchase or sale of their home:

* Seller misunderstanding what “as-is” condition means.

* How to deal with multiple offers.

* Husband or wife didn’t sign the REPC. Causes dispute over validity of the contract.

* CC&R’s not given to buyer causing problems.

* Seller disclosure form not delivered to buyer by the deadline. Causing lawsuit.

* Buyer not reviewing the Commitment for Title Insurance.

* Seller not providing Buyer Agent with Commitment for Title insurance by the deadline.

* Double contract. Loan fraud.

* Not using the correct contract or disclosure form in the appropriate situation.

* Buyer’s receive the key prior to recording, funding doesn’t occur, dispute arises.

* Buyer moving from out of state on friday to Settle at title company, doesn’t fund until Tuesday (Monday is a holiday) and becomes upset.

* Confusion on how the Time Clause Addendum works. Causing a disagreement.

* Lease agreements not provided to buyer before seller disclosure deadline.

* Low appraisal. Buyer sends notice of cancellation but forgets to include the appraisal.

* Multiple offers. Seller puts the property under contract with two buyers at the same time. Dispute arises.

* Counter offer is not withdrawn before accepting another offer. Problem arises.

* 10 different addenda included with the REPC. Confusion as to what has been agreed upon.

* Subject to Sale contingency not satisfied causing a domino effect resulting in two cancelled contracts.

* Missing initials on one page of the REPC causing a dispute.

* Seller repairs not completed. What to do next?

* Not delivering a document by the deadline. Dispute arises.

* Mold in the home detected. Who is responsible? Can I cancel the contract?

* Termites or radon detected in the home. What do I do now?

* No legal access to the lot. Implied easement issue.

* $10,000 earnest money not delivered by the buyer on time. Major dispute arises.

* Money wired and lost due to wire fraud.

* Mechanics lien filed on home that was “recently remodeled.”

* Sloppy language in an addendum causing a dispute.

* Air conditioner doesn’t work.

* Conflict between what is on the MLS and what is in the REPC.

* Multiple offers disclosed without seller approval, prospective buyers back out.

* Seller decides not to sell a week before settlement. Seller default. Lawsuit arises.

* Buyer backing out after deadlines expires. Buyer default. Lawsuit arises.

* Dispute over who pays for the HOA transfer fee.

* Dispute over who pays for the HOA special assessment.

* After Settlement but prior to Funding & Recording, house is vandalized.

* Missing dates on the REPC.

* Can’t get the HOA docs.

* Language on the REPC crossed out causing ambiguity.

* Sections of the REPC left blank causing ambiguity.

* The wrong address listed on the REPC.

* Two addendum number 4 – causing ambiguity and dispute.

* Seller failing to disclose major structural problem with the home.

* Fair Housing issue created after buyer submits letter with offer.

* “TBD” filled in on the REPC in too many places causing uncertainty.

* Poorly filled out forms and contracts causing problems.

* Representing multiple buyers at the same time on the same property causing a conflict.

* Angry tenant when showing a property.

* Seller didn’t accurately fill out the seller disclosure form.

* Checking “Acceptance” on page 6 of the REPC, then checking “Counter” on Addendum #1 that was also included in the offer.

Hiring an experienced Realtor® will be the best money you spend this year.

Originally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some even worried that we might relive the 2006-2008 housing crash all over again. Once you examine the data, however, that seems unlikely.

As reported by Odeta Kushi, Deputy Chief Economist for First American:

“Despite the federal foreclosure moratorium, there were fears that up to 30% of homeowners would require forbearance, ultimately leading to a foreclosure tsunami. Forbearance did not hit 30%, but rather peaked at 8.6% and has been steadily falling since.”

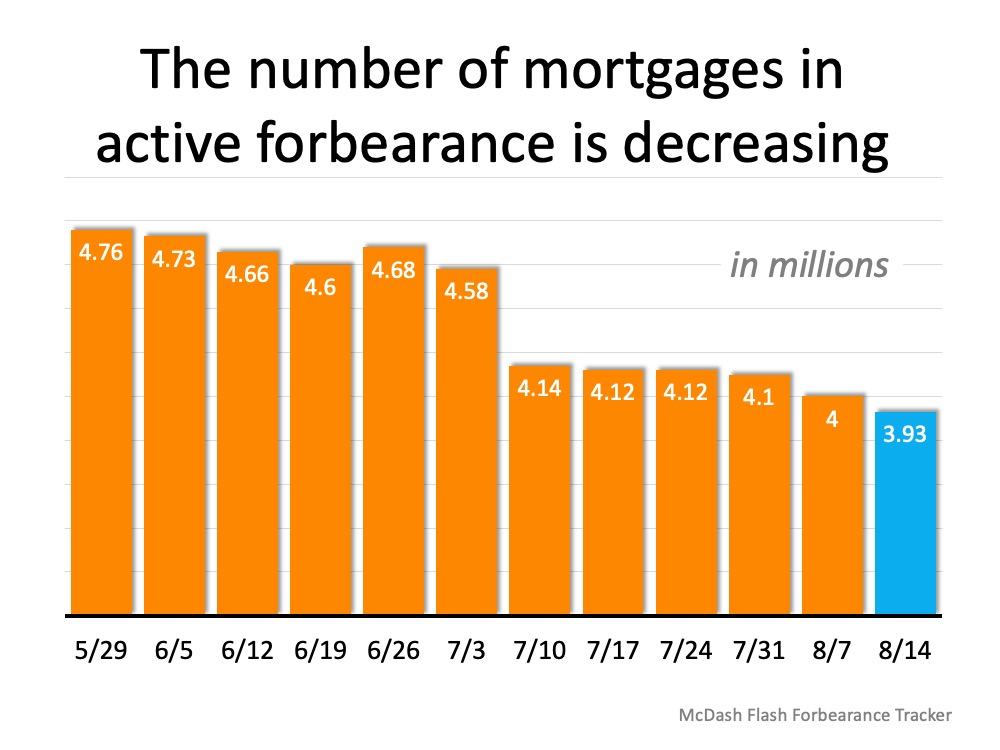

According to the most current data from Black Knight, the percentage of homes in forbearance has fallen to 7.4%. The report also gives the decrease in raw numbers:

“The overall trend of incremental improvement in the number of mortgages in active forbearance continues. According to the latest data from Black Knight’s McDash Flash Forbearance Tracker, the number of mortgages in active forbearance fell by another 71,000 over the past week, pushing the total under 4 million for the first time since early May.”

Here’s a graph showing the decline in forbearances over the last several months: The report also explains that across the board, overall forbearance activity fell with 10% fewer new forbearance requests and nearly 40% fewer renewals.

The report also explains that across the board, overall forbearance activity fell with 10% fewer new forbearance requests and nearly 40% fewer renewals.

Kushi also addresses this question:

“There are two main reasons why this crisis is unlikely to produce a wave of foreclosures similar to the 2008 recession. First, the housing market is in a much stronger position compared with a decade ago. Accompanied by more rigorous lending standards, the household debt-to-income ratio is at a four-decade low and household equity near a three-decade high. Indeed, thus far, MBA data indicates that the majority of homeowners who took advantage of forbearance programs are either staying current on their mortgage or paying off the loan through a home sale or a refinance. Second, this service sector-driven recession is disproportionately impacting renters.”

Today, the options available to homeowners will prevent a large spike in foreclosures. That’s good not just for those families impacted, but for the overall housing market. A recent study by Fannie Mae, however, reveals that many Americans are not aware of the options they have.

It’s imperative for potentially impacted families to better understand the mortgage relief programs available to them, for their personal housing situation and for the overall real estate market.

If Americans fully understand their options and make good choices regarding those options, the current economic slowdown does not need to lead to mass foreclosures.

In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand. Now, however, we’re seeing sellers slowly starting to come back into the market, a bright spark for potential buyers. Javier Vivas, Director of Economic Research at realtor.com, explains:

“Seller confidence has been improving gradually after reaching its bottom in mid-April, and now it appears to have reached an important recovery milestone…After five long months, sellers are back in the housing market; while encouraging, the improvement to new listings is only the first step in the long road to solving low inventory issues keeping many buyers at bay.”

Even with the number of homes coming into the market, the available inventory is well below where it needs to be to satisfy buyer interest. The National Association of Realtors (NAR) reports:

“Total housing inventory at the end of June totaled 1.57 million units, up 1.3% from May,but still down 18.2% from one year ago (1.92 million). Unsold inventory sits at a 4.0-month supply at the current sales pace, down from both 4.8 months in May and from the 4.3-month figure recorded in June 2019.”

Houses today are selling faster than they’re coming to market. That’s why we only have inventory for 4 months at the current sales pace when in reality we need inventory for 6 months to keep up. But, as mentioned above, sellers are starting to return to the game. Realtor.com explains:

“The ‘housing supply’ component – which tracks growth of new listings – reached 101.7, up 4.9 points over the prior week, finally reaching the January growth baseline. The big milestone in new listings growth comes as seller sentiment continues to build momentum…After constant gradual improvements since mid-April, seller confidence appears to be reaching an important milestone. The temporary boost in new listings comes as the summer season replaces the typical spring homebuying season. More homes are entering the market than typical for this time of the year.”

A good time to enter the housing market is when the competition in your area is low, meaning there are fewer sellers than interested buyers. You don’t want to wait for all of the other homeowners to list their houses before you do, providing more options for buyers to choose from. With sellers starting to get back into the market after five months of waiting, if you want to sell your house for the best possible price, now is a great time to do so.

It can be challenging to find a home in today’s low-inventory environment. If more sellers are starting to put their houses up for sale, there will be more homes for you to choose from, providing a better opportunity to find the home of your dreams while taking advantage of the affordability that comes with historically low mortgage rates.

While we still have a long way to go to catch up with the current demand, inventory is slowly starting to return to the market. If you’re thinking of moving this year, let’s connect today so you’re ready to make your move when the home of your dreams comes up for sale.

The news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand exactly what’s going on and what it means relative to the road ahead. We’ve talked before about what experts expect in the second half of this year, and today that progress largely hinges upon the continued course of the virus.

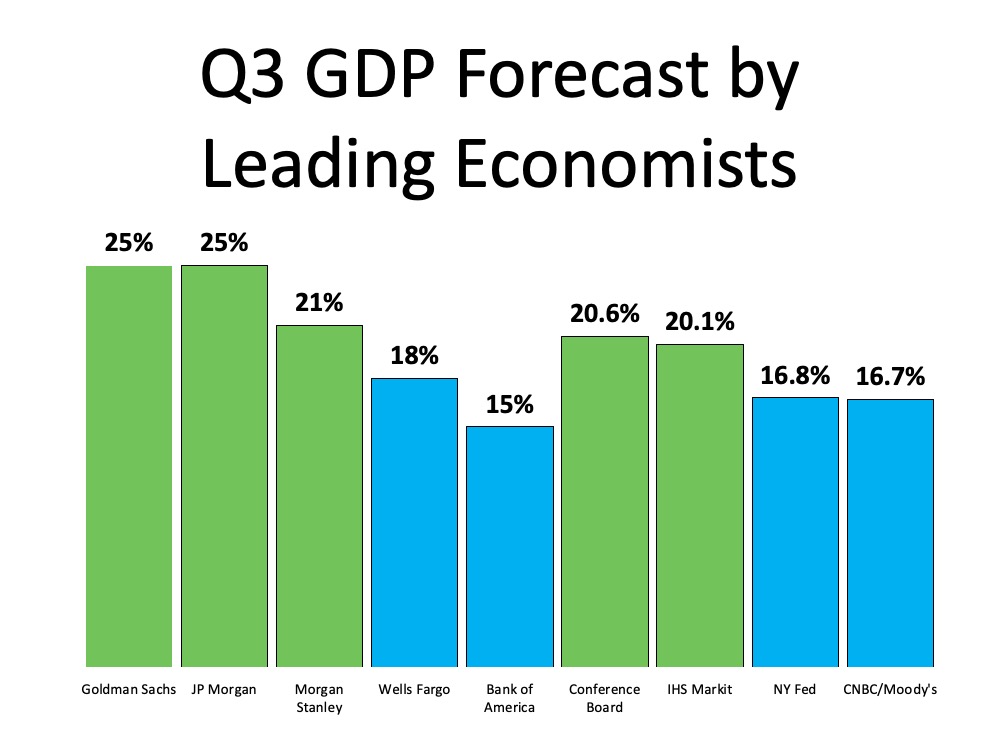

A recent Wall Street Journal survey of economists noted, “A strong economic recovery depends on effective and sustained containment of Covid-19.” Given the uncertainty around the virus, we can also see what economists are forecasting for GDP in the third quarter of this year (see graph below): Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, with 5 of the 9 experts indicating over 20% growth.

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, with 5 of the 9 experts indicating over 20% growth.

Lisa Shalett, Chief Investment Officer for Morgan Stanley puts it this way:

“Indeed, the ‘worst ever’ GDP reading could be followed by the ‘best ever’ growth in the third quarter.”

As we look forward, we can expect consumer spending to improve as well. According to Opportunity Insights, as of August 1, consumer spending was down just 7.8% as compared to January 1 of this year.

An economic recovery is beginning to happen throughout the country. While there are still questions that need to be answered about the road ahead, we can expect to see improvement this quarter.