Should you have your home pre-appraised before placing it on the Market?

In the complex and often unpredictable journey of selling a home, understanding the value of your property through a pre-listing appraisal emerges as a critical step that can significantly impact the outcome of your sale. This introduction to pre-listing appraisals delves into how an accurate assessment of your home’s worth not only enhances your negotiating stance but also streamlines the selling process, paving the way for a smoother transaction. In an ever-evolving real estate market, having a clear picture of your property’s value places you in a formidable position to make informed decisions, ensuring that you navigate your home sale with confidence and strategic insight.

Leveraging Your Appraisal In The Home Selling Process

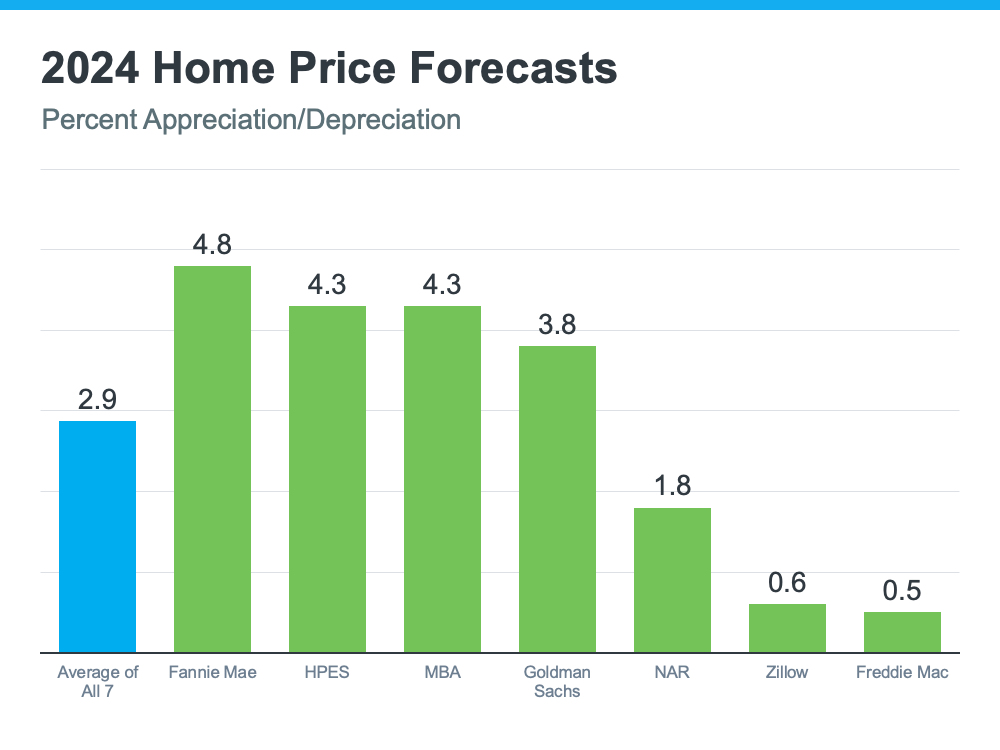

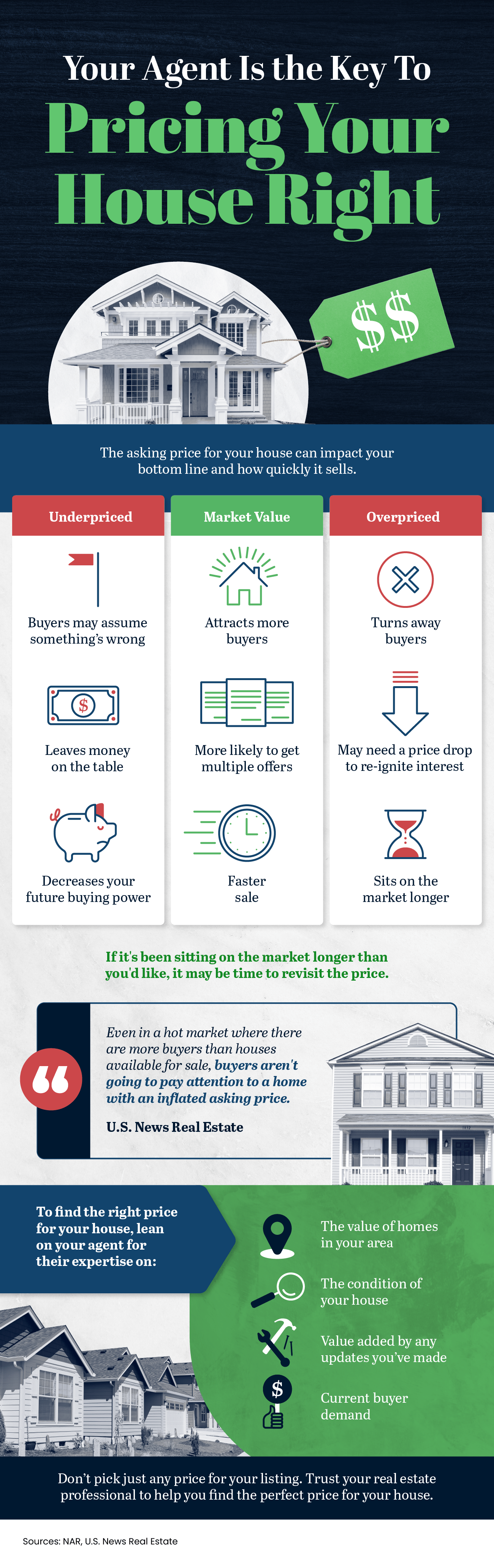

In the intricate process of selling your home, a pre-listing appraisal emerges as a pivotal tool that not only determines the market value of your property but also provides a sturdy foundation for pricing strategies. This appraisal, an unbiased valuation by a professional, plays a critical role in the dynamics of real estate transactions, influencing not just how the property is marketed but also how negotiations are approached. For sellers, understanding and leveraging this appraisal can significantly streamline the selling process, making it less about guesswork and more about strategic decision-making. By accurately setting the listing price in line with the appraisal value, sellers can avoid the pitfalls of overpricing, which may lead to prolonged market time, or underpricing, which can result in financial loss.

Furthermore, a pre-listing appraisal equips sellers with a powerful negotiation tool. In scenarios where potential buyers present offers that are significantly lower than the listing price, the appraisal report serves as a credible reference point that justifies the price set by the seller. It can also expedite the selling process by providing prospective buyers with the assurance that the property is priced appropriately, possibly reducing the time it spends on the market. Additionally, in the event of a buyer’s appraisal coming in lower than the agreed-upon selling price, the pre-listing appraisal can be a critical asset in renegotiating the deal, ensuring that the seller remains in a strong bargaining position. Therefore, integrating a pre-listing appraisal into the home selling strategy not only enhances the seller’s confidence in the accuracy of their listing price but also fortifies their negotiation stance, potentially leading to more favorable outcomes.

Interpreting Your Pre-Listing Appraisal Results

Once you have received your pre-listing appraisal report, crucial insights await that can significantly influence the direction of your home sale. This document is not just a valuation; it encapsulates a comprehensive analysis of your property against current market trends, comparable sales, and the unique attributes of your home. Understanding the nuances of this report is pivotal in setting a competitive yet realistic listing price. An overpriced home can languish on the market, while underpricing can lead to a speedy transaction but at the cost of potential profits. Thus, interpreting the appraisal results with a strategic mindset is paramount in aligning your pricing strategy with market expectations and your selling objectives.

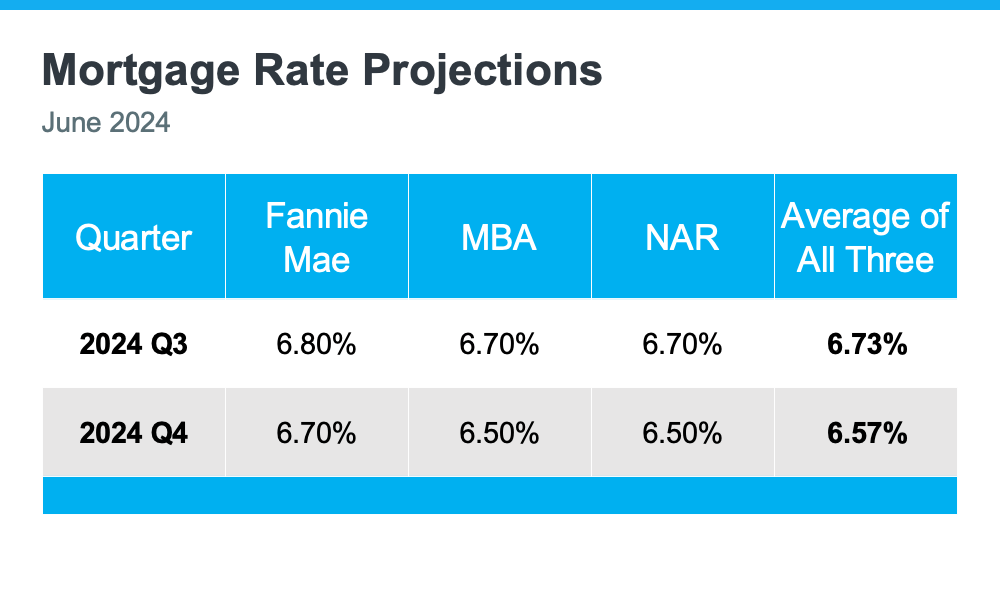

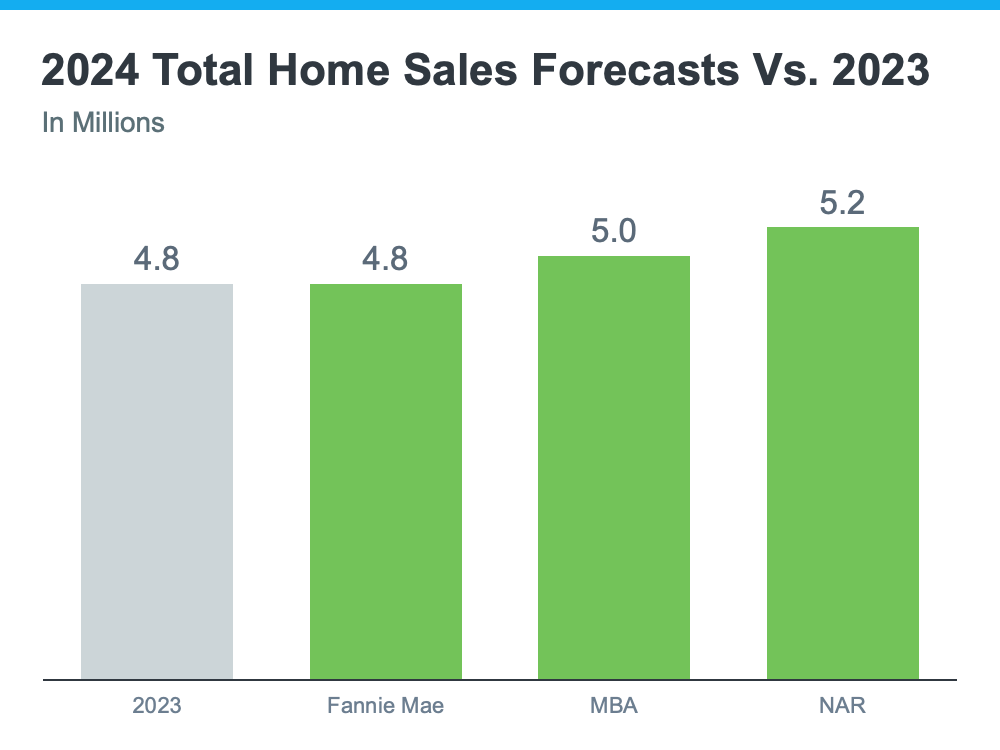

The appraisal report will typically include detailed comments on the condition and qualities of your home, adjustments for differences between your property and comparable sales, and an analysis of the local real estate market. It’s imperative to pay close attention to the comparable sales chosen, as these play a vital role in determining your home’s appraised value. If the selected comparables do not align closely with your perception of your property, consulting with your appraiser or a real estate agent can provide clarity and possibly a re-evaluation based on new information. Additionally, understanding the local market analysis provided can offer insights beyond just your home’s valuation, such as time-on-market forecasts and price trends, which are invaluable for timing your listing to maximize returns.

How To Prepare For A Pre-Listing Appraisal

When gearing up for a pre-listing appraisal, ensuring your property is in its best possible condition is paramount. This does not necessarily mean undertaking major renovations or costly upgrades but focusing on maximizing the existing appeal and addressing any glaring issues that could negatively affect valuation. A clean, clutter-free environment, for instance, can significantly enhance the perception of your home, making it appear larger and more inviting. Therefore, investing time in deep cleaning, decluttering, and even a fresh coat of paint in neutral colors can make a considerable difference. Additionally, ensure that all maintenance issues, no matter how minor they might seem, such as a leaky faucet or a squeaky door, are rectified. These small details can have an outsized impact on the appraiser’s assessment of your home’s condition and worth.

Beyond aesthetic and maintenance considerations, preparing the necessary documentation can streamline the appraisal process and possibly affect the outcome favorably. Compile a comprehensive list of all updates, repairs, and improvements made to the property, with dates and expenditure if possible. This should include everything from significant renovations to minor upgrades, such as a new water heater or upgraded windows. Providing receipts or permits for these works can further validate your claims. Additionally, be aware of recent sales of comparable homes in your area, as this information can provide context for your home’s valuation. While appraisers conduct their independent research, offering documentation that highlights your home’s best features and improvements can influence their understanding and assessment of your property’s market value.

Understanding The Importance Of Pre-Listing Appraisals

When preparing to sell a home, understanding the value of pre-listing appraisals becomes critical. A pre-listing appraisal is an unbiased professional assessment of a property’s worth before it’s listed on the market, performed by a certified appraiser. This step is often overlooked, yet it plays a pivotal role in the home-selling process. It arms the seller with a realistic understanding of their property’s market value, which is essential for setting a competitive yet fair listing price. An accurately priced home not only attracts more potential buyers but also paves the way for a smoother negotiation process, as the asking price is backed by a professional appraisal.

Moreover, a pre-listing appraisal offers benefits that extend beyond pricing. It provides a comprehensive look at what features of the home add the most value and what areas might need improvement before the property is listed, giving sellers the opportunity to make necessary repairs or upgrades that could enhance the home’s value. Additionally, this appraisal can serve as a powerful negotiating tool once offers start coming in. If buyers are aware that the asking price is appraised by a professional, they are likely to perceive the price as more valid and fair, potentially reducing the negotiation phase’s length and complexity. The appraisal report can also provide a safeguard against low appraisals in the selling process, ensuring that the agreed-upon price is justified and reflecting the home’s true value.

In conclusion, mastering the intricacies of a home sale requires a comprehensive approach, and leveraging the insights from pre-listing appraisals is a key facet of this process. Understanding its importance, preparing adequately for it, and interpreting its results effectively can offer home sellers a significant advantage in the real estate market. By doing so, sellers not only position their property competitively but also navigate the complexities of the sale with greater confidence and informed decision-making. Ultimately, a pre-listing appraisal is not merely a preliminary step but a strategic tool that can greatly influence the outcome of your home-selling journey.

Marty is a PSA – Pricing Strategy Adviser and Principal Broker of the Real Estate Brokerage “Utah Realty”