Keys to Selling Your House Virtually

Keys to Selling Your House Virtually

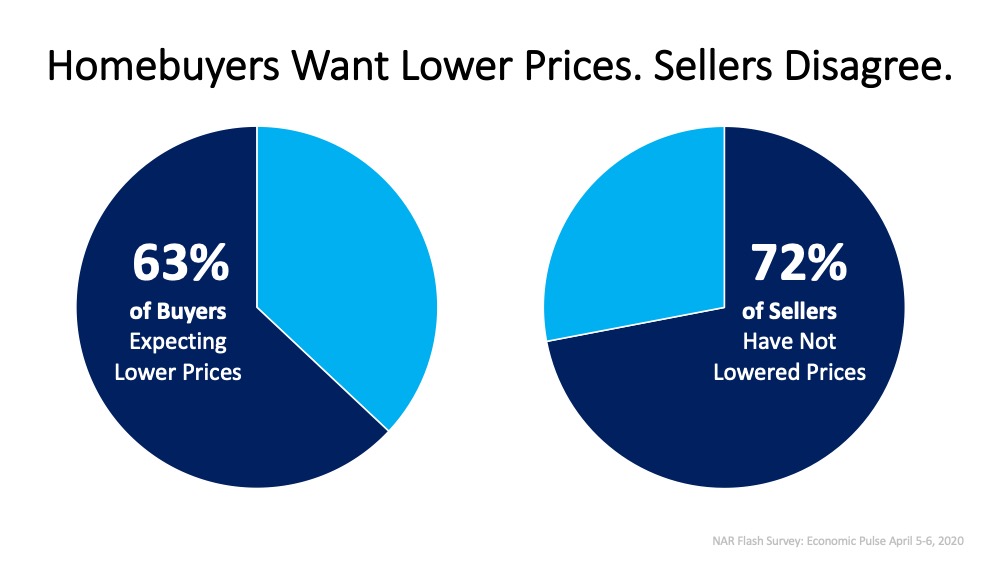

In a recent survey by realtor.com, people thinking about selling their homes indicated they’re generally willing to allow their agent and some potential buyers inside if done under the right conditions. They’re less comfortable, however, hosting an open house. This is understandable, given the health concerns associated with social contact these days. The question is, if you need to sell your house now, what virtual practices should you use to make sure you, your family, and potential buyers stay safe in the process?

In today’s rapidly changing market, it’s more important than ever to make sure you have a digital game plan and an effective online marketing strategy when selling your house. One of the ways your agent can help with this is to make sure your listing photos and virtual tours stand out from the crowd, truly giving buyers a detailed and thorough view of your home.

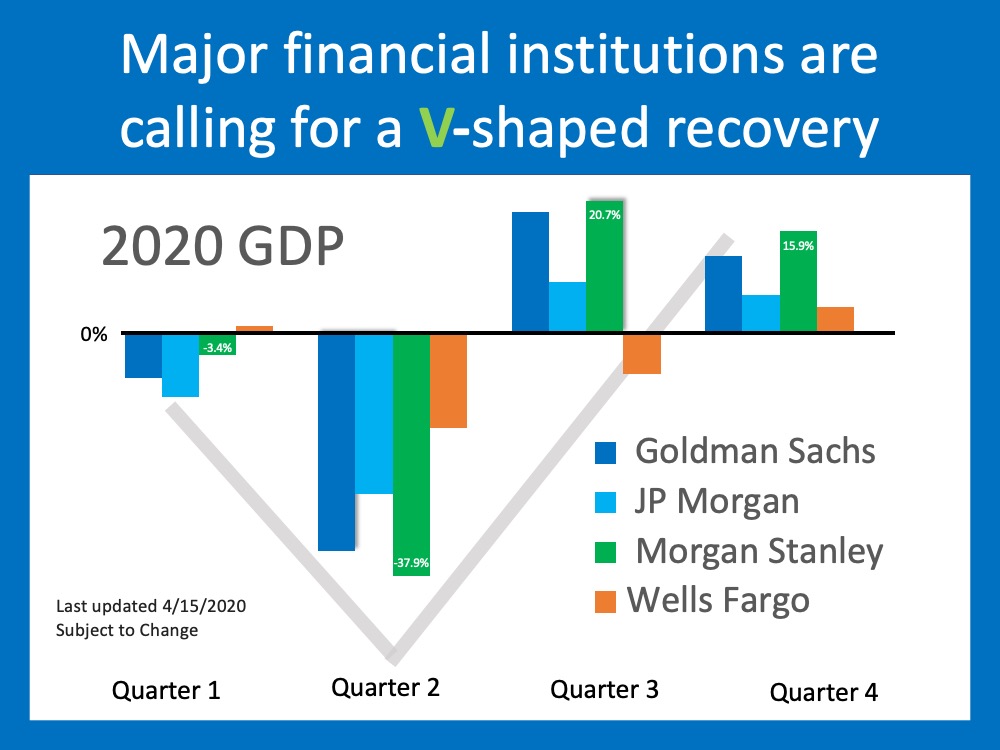

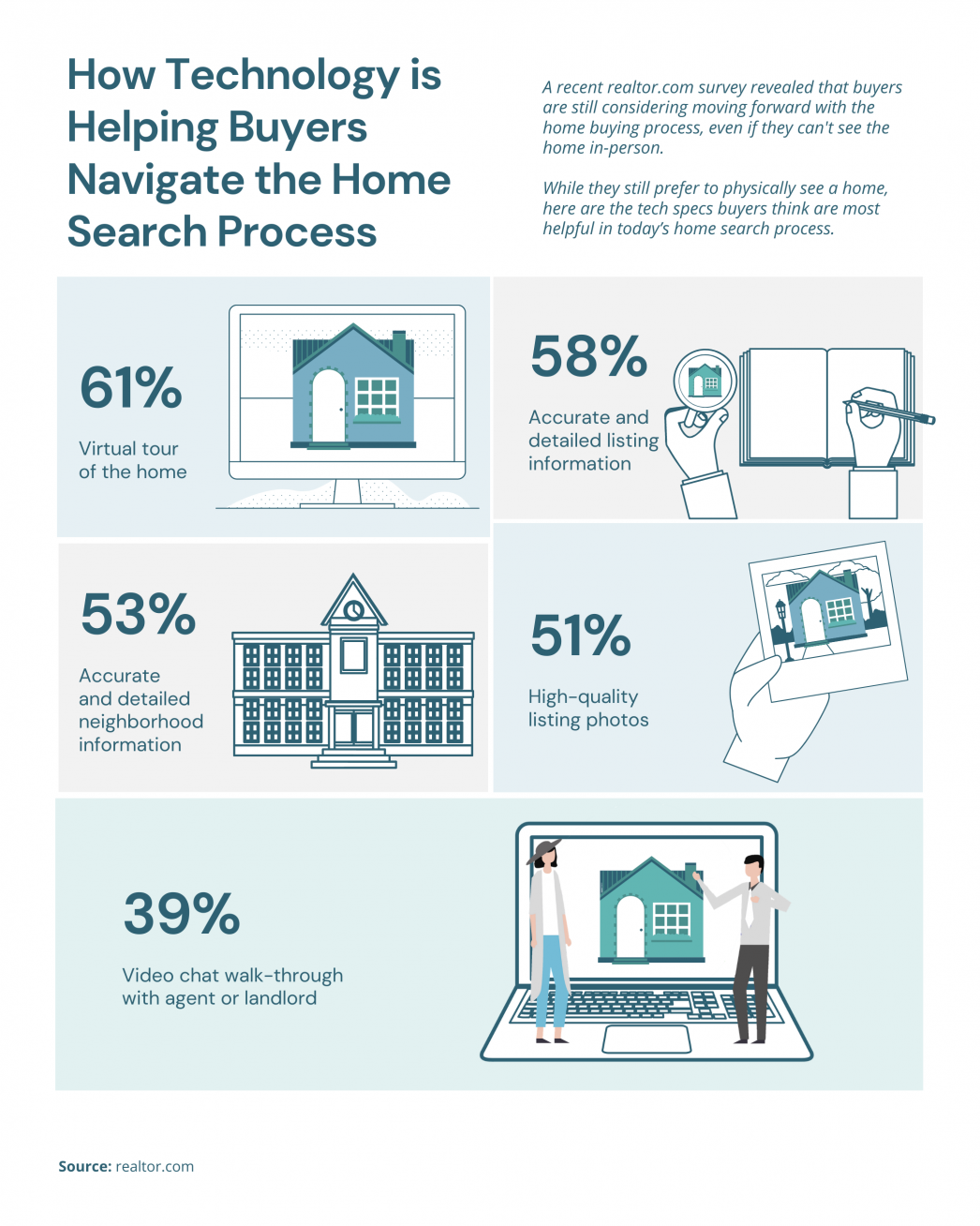

So, if you’re ready to move forward, virtual practices may help you win big when you’re ready to sell. While abiding by state and local regulations is a top priority, a real estate agent can help make your sale happen. Agents know exactly what today’s buyers need, and how to put the necessary digital steps in place. For example, according to the same survey, when asked to select what technology would be most helpful when deciding on a new home, here’s what today’s homebuyers said, in order of preference:

- Virtual tour of the home

- Accurate and detailed listing information

- Detailed neighborhood information

- High-quality listing photos

- Agent-led video chat

After leveraging technology, if you have serious buyers who still want to see your house in person, keep in mind that according to the National Association of Realtors (NAR), there are ways to proceed safely. Here are a few of the guidelines, understanding that the top priority should always be to obey state and local restrictions first:

- Limit in-person activity

- Require guests to wash their hands or use an alcohol-based sanitizer

- Remove shoes or cover with booties

- Follow CDC guidance on social distancing and wearing face coverings

Getting comfortable with your agent – a true trusted advisor – taking these steps under the new safety standards might be your best plan. This is especially important if you’re in a position where you need to sell your house sooner rather than later.

Nate Johnson, CMO at realtor.com ® notes:

“As real estate agents and consumers seek out ways to safely complete these transactions, we believe that technology will become an even more imperative part of how we search for, buy and sell homes moving forward.”

It sounds like some of these new practices might be here to stay.

Bottom Line

In a new era of life, things are shifting quickly, and virtual strategies for sellers may be a great option. Opening your doors up to digital approaches may be game-changing when it comes to selling your house. Let’s connect so you have a trusted real estate professional to help you safely and effectively navigate through all that’s new when it comes to making your next move.