Want to Make a Move? Homeowner Equity is Growing Year-Over-Year

Want to Make a Move? Homeowner Equity is Growing Year-Over-Year

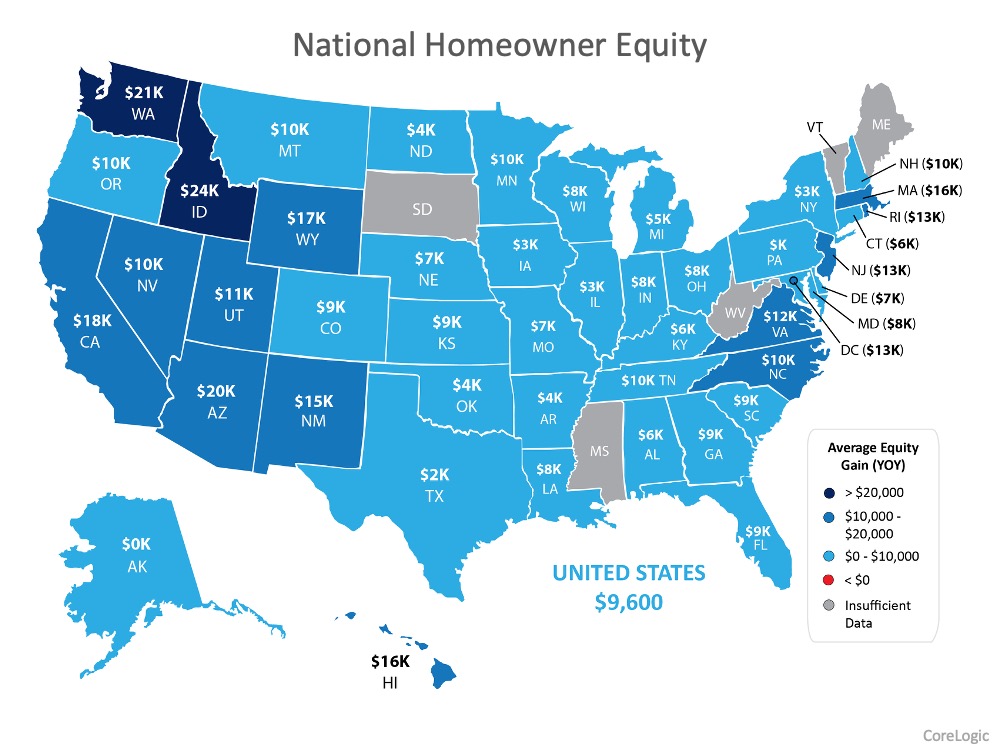

One of the bright spots of the 2020 real estate market is the growth in equity homeowners are experiencing across the country. According to the recently released Homeowner Equity Insights Report from CoreLogic, in nearly every state there was a year-over-year first-quarter equity increase, averaging out to a 6.5% overall gain.

The report notes:

“CoreLogic analysis shows U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a total of nearly $590 billion since the first quarter of 2019, an increase of 6.5%, year over year.” (See map below):

This means that “In the first quarter of 2020, the average homeowner gained approximately $9,600 in equity during the past year.”

This means that “In the first quarter of 2020, the average homeowner gained approximately $9,600 in equity during the past year.”

That’s a huge win for homeowners, especially for those looking to sell their houses and make a move this summer. Having equity to re-invest in your next home is a major force that can make moving a reality, especially while buyers are expressing such a high demand for homes to purchase.

Frank Martell, President and CEO of CoreLogic addresses the potential long-term outlook and how homeowners will likely fare much more positively through the current recession than many did during the last one:

“Many homeowners will experience a recession during their lifetime, and it is reasonable to compare the current recession to those in the past. But the comparison is not apples to apples — every recession is different. Primary drivers of the Great Recession were an overbuilt housing stock, risky mortgages and the collapse of home prices, creating a massive increase in negative equity that proved difficult to recover from. Today’s housing environment has low vacancy and delinquency rates and a large home equity cushion.”

Bottom Line

Now is a great time to consider leveraging your equity and making a move, especially while buyer interest is high. Let’s connect to explore your equity position and make your next move a reality.

Three Reasons Homebuyers Are Ready to Purchase In 2020

Three Reasons Homebuyers Are Ready to Purchase This Year

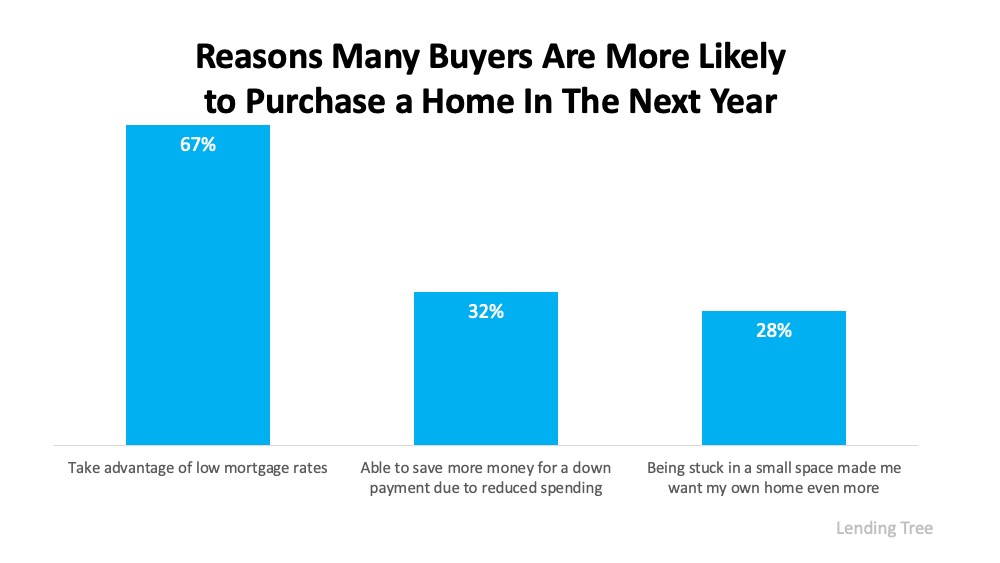

A recent survey by Lending Tree tapped into behaviors of over 1,000 prospective buyers. The results indicated 53% of all homebuyers are more likely to buy a home in the next year, even amid the current health crisis. The survey further revealed why, naming several reasons buyers are more likely to move this year (see graph below): Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

1. Low Mortgage Rates

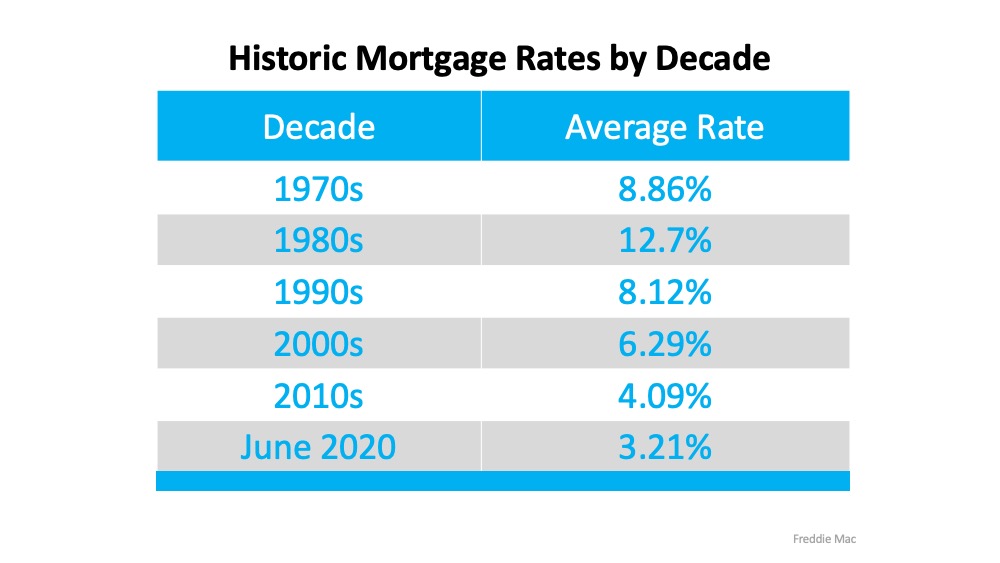

The biggest reason potential homebuyers indicated they’re eager to purchase this year is due to current mortgage rates, which are hovering near all-time lows. Today’s low rates are making it more affordable than ever to buy a home, which is a huge incentive for purchasers. In fact, 67% of respondents in the Lending Tree survey want to take advantage of low mortgage rates. This is no surprise when comparing historic mortgage rates by decade (see below): Sam Khater, Chief Economist at Freddie Mac recently said:

Sam Khater, Chief Economist at Freddie Mac recently said:

“As the economy is slowly rebounding, all signs continue to point to a solid recovery in home sales activity heading into the summer as prospective buyers jump back into the market. Low mortgage rates are a key factor in this recovery.”

2. Reduced Spending

Some people have also been able to save a little extra money over the past few months while sheltering in place. One of the upsides of staying home recently is that many have been able to work remotely and minimize extra spending on things like commuting expenses, social events, and more. For those who fall into this category, they may have a bit more saved up for down payments and closing costs, making purchasing a home more feasible today.

3. Re-Evaluating Their Space

Spending time at home has also given buyers a chance to really evaluate their living space, whether renting or as a current homeowner. With time available to craft a wish list of what they really need in their next home, from more square footage to a more spacious neighborhood, they’re ready to make it happen.

What does this mean for buyers and sellers?

With these three factors in play, the demand for housing will keep growing this year, especially over the summer as more communities continue their phased approach to reopening. Buyers can take advantage of additional savings and low mortgage rates. And if you’re thinking of selling, know that your home may be in high demand as buyer interest grows and the number of homes for sale continues to dwindle. This may be your moment to list your house and make a move into a new space as well.

Bottom Line

If you’re ready to buy or sell – or maybe both – let’s connect to put your plans in motion. With low mortgage rates leading the way, it’s a great time to take advantage of your position in today’s market.

Utah Realty has ALL THE PROPERTIES IN UTAH available current and up to date. EVERYDAY ALL DAY. Sent to our server from all Brokerages and Agents in real time. https://utahrealtyplace.com/properties/

Real Estate Tops Best Investment Poll for 7th Year Running

Real Estate Tops Best Investment Poll for 7th Year Running

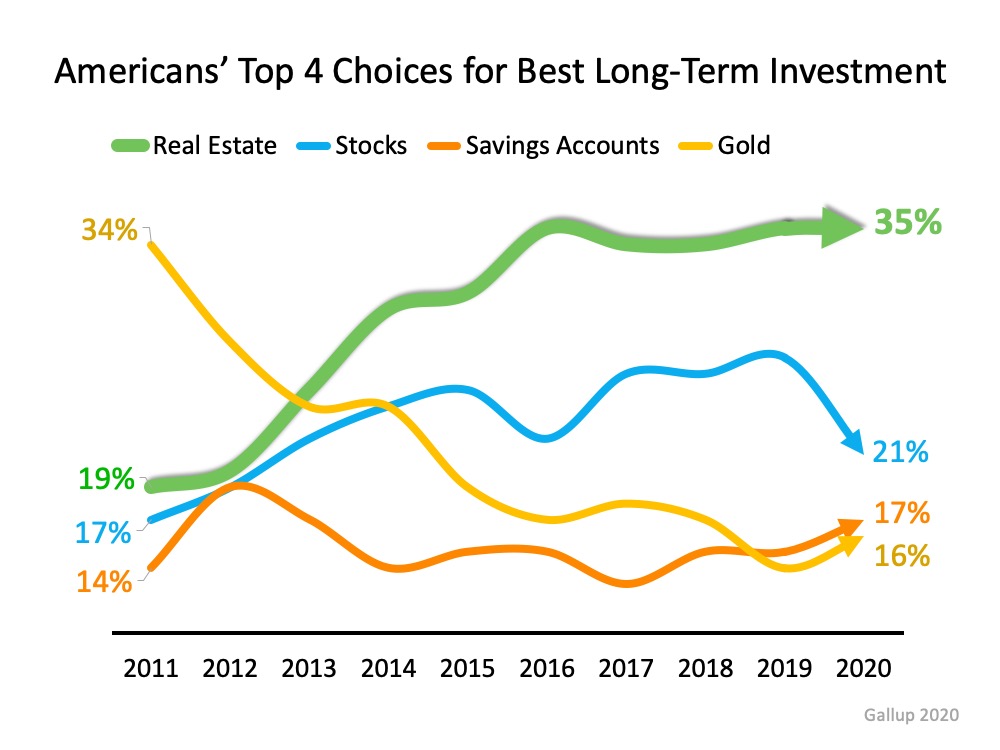

Every year, Gallup conducts a survey of Americans to determine their choice for the best long-term investment. Respondents are asked to select real estate, stocks/mutual funds, gold, savings accounts/CDs, or bonds.

For the seventh year in a row, real estate has come out on top as the best long-term investment. Gallup explained:

“Real estate remains the most favored investment to Americans, as has been the case since 2013, when the housing market was on the rebound. More than a third of Americans have named real estate as the top investment since 2016.”

This year’s results indicated 35% of Americans chose real estate, followed by stocks at 21%. The full results covering the last decade are shown in the chart below:

Bottom Line

The belief of the American people in the stability of housing as a long-term investment remains strong, even through the many challenges our economy faces today.

How Did Covid-19 pandemic affect Salt Lake County home sales

How did the Covid-19 pandemic affect Salt Lake County home sales?

In April, sales of all housing types fell to an eight-year low, and were down 28 percent compared to April 2019. The silver lining? Deferred spring home sales are now being realized as the market rebounds. Mortgage interest rates are now at a 50-year low, driving home buyer demand.

Are You Ready for the Summer Housing Market?

Are You Ready for the Summer Housing Market?

As the health crisis started making its way throughout our country earlier this spring, sellers have been cautious about putting their homes on the market. This hesitation stemmed primarily from fear of the spread of the coronavirus, and understandably so. This abundant caution has greatly impacted the number of homes for sale and slowed the pace of a typically busy spring real estate season. Mark Fleming, Chief Economist at First American notes:

“As more homeowners are reluctant to list their homes for sale amid the pandemic, the supply of homes available to potential home buyers continues to dwindle.”

With many states beginning a phased approach to reopening, virtual best practices and health and safety guidelines for the industry are in place to increase the comfort level of buyers and sellers. What we see today, though, is that sellers are still making a very calculated return to the market. In their latest Weekly Housing Trends Report, realtor.com indicates:

“New listings: On the slow path to recovery. Nationwide the size of declines held mostly steady this week, dropping 23 percent over last year, a slight increase over last week but still an improvement over the 30 percent declines in the first half of May.”

Although we’re starting to inch our way toward more homes for sale throughout the country, the number of homes on the market is still well below the demand from buyers. In the same report, Javier Vivas, Director of Economic Research for realtor.com shares:

“Sellers have yet to come back in full force, limiting the availability of homes for sale. Total active listings are declining from a year ago at a faster rate than observed in previous weeks, and this trend could worsen as buyers regain confidence and come back to the market before sellers.”

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) seems to agree:

“In the coming months, buying activity will rise as states reopen and more consumers feel comfortable about homebuying in the midst of the social distancing measures.”

What we can see today is that homebuyers are more confident than the sellers, and they’re ready to make up for lost time from the traditional spring market. Summer is gearing up to be the 2020 buying season, so including your house in the mix may be your best opportunity to sell yet. Interest in your house may be higher than you think with so few sellers on the market today. As Vivas says:

“More properties will have to enter the market in June to bring the number of options for buyers back to normal levels for this time of the year, nationwide and in all large markets.”

Bottom Line

If you’re ready to sell your house this summer, let’s connect today. Buyers are interested and they may be looking for a house just like yours.