Secrets to a Successful Sale of Your Home

In the intricate dance of real estate, where emotion meets investment, the art of selling your home demands a blend of strategy, finesse, and keen insight. As navigators through the ever-evolving property landscape

, homeowners poised to make their move must arm themselves with the essential tools and knowledge to carve a path to success. This article distills the essence of that journey, offering crucial tips and guiding principles that pave the way for an efficient and rewarding sale. From understanding market dynamics to presenting your home in its best light, we delve into the professional tactics that can transform the daunting process of selling into a smooth and profitable venture.

Navigating The Closing Process

Navigating the closing process of a home sale can often appear

as a daunting final hurdle for sellers, yet underst

anding and preparing for it can significantly smoothen this last phase. The closing process begins once the seller accepts an offer, and it encompasses several key steps including home inspections, appraisals, and the finalization of the buyer’s financing. It’s imperative for sellers to stay organized and responsive during this period, as delays or complications can arise from any of these steps. Ensuring that all the necessary paperwork is in order, from the disclosure documents to the deed, can expedite this process. Collaboration with a knowledgeable real estate agent or attorney can provide invaluable guidance through these complexities, ensuring that legal requirements are fulfilled accurately and efficiently.

Another critical element in navigating

the closing process effectively is to be prepared for the closing costs, which can include agent commissions, attorney fees, and possible repairs or credits negotiated with the buyer. These expenses can add up and should be budgeted for well in advance of the closing date. Understanding these costs and who is responsible for each can prevent surprises and disputes during closing. Furthermore, open communication with the buyer can help to maintain a positive atmosphere throughout the transaction, providing clarity and building trust. Completing a final walkthrough of the property with the buyer is not only a standard procedure but also an opportunity to address any last-minute concerns that could otherwise derail the closing. Through careful preparation and clear communication, sellers can navigate the closing process more confidently, leading to a successful and satisfying conclusion of the home selling journey.

Setting The Right Price

Having a Real Estate Broker with a Pricing Stragegy Advisor Designation is Key to Your Success.

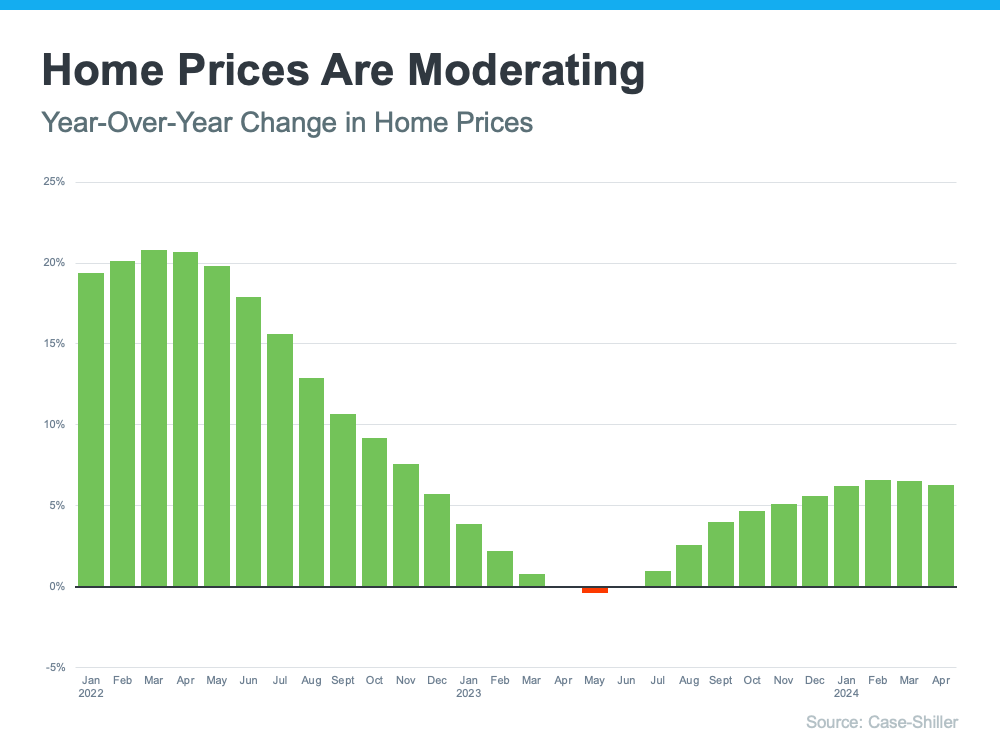

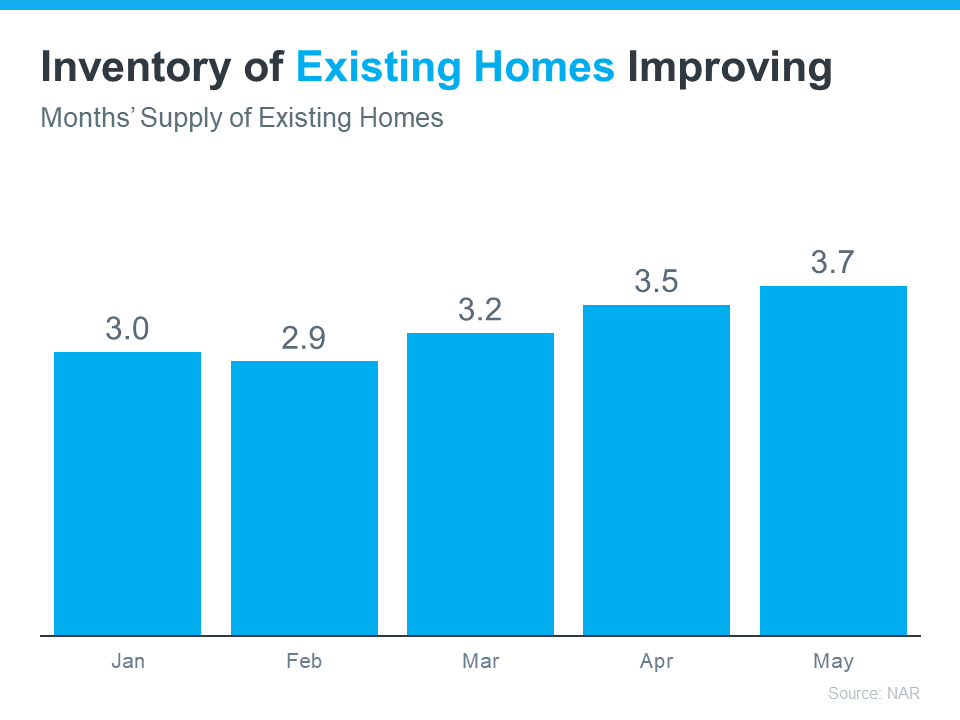

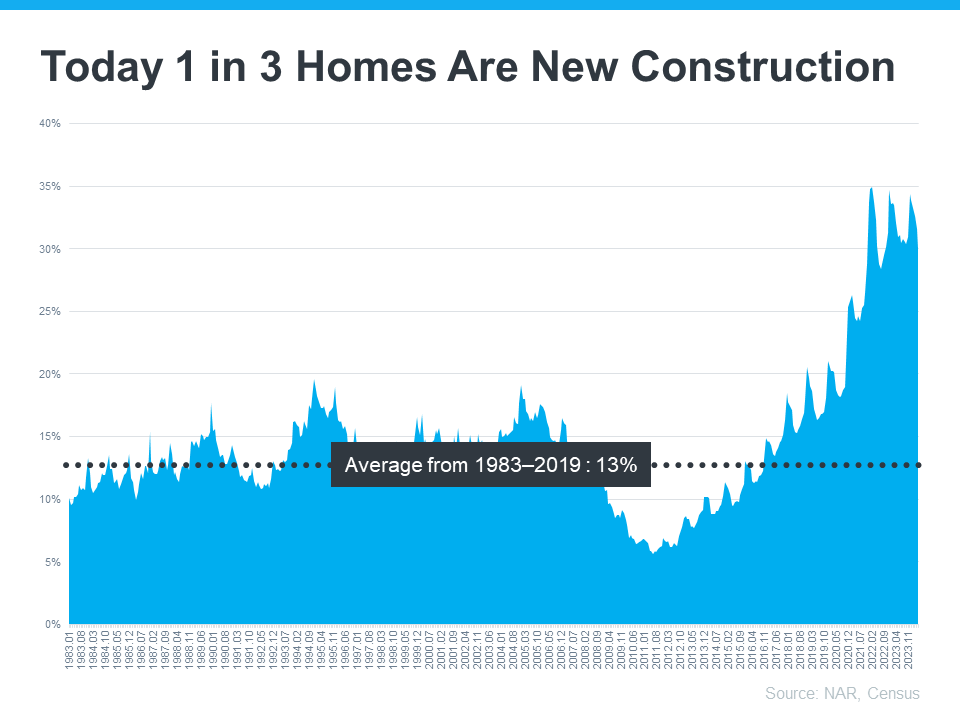

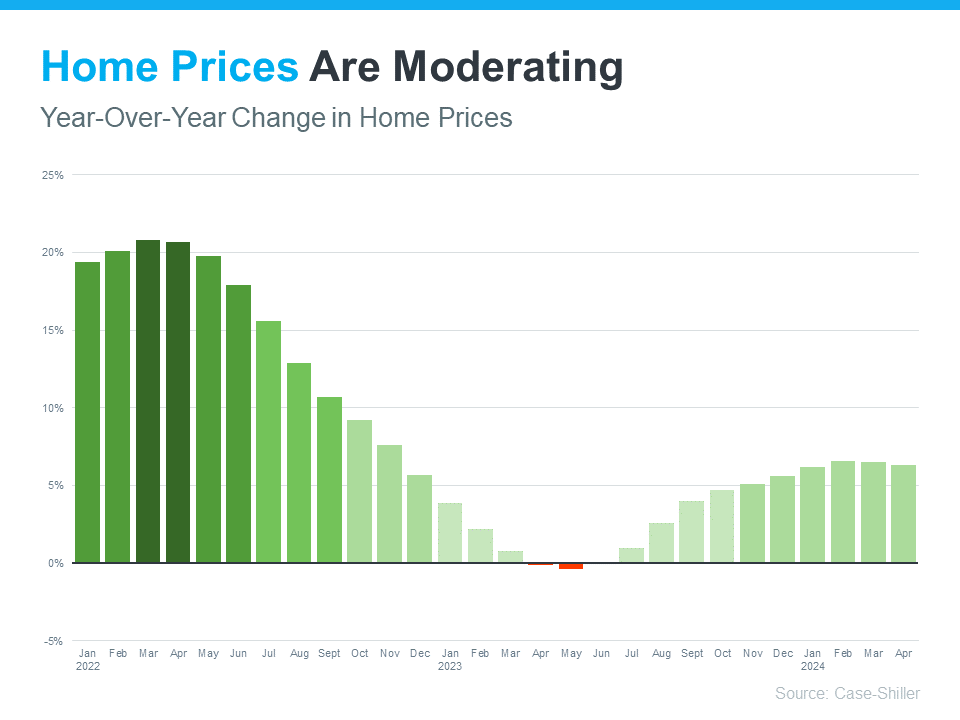

Setting the right price for your home is a critical step in the selling process, one that demands a balance between attracting serious buyers and achieving your desired financial outcome. It begins with understanding the current market conditions and how your home fits within this landscape. A comparative market analysis (CMA) is an invaluable tool in this regard, providing insight into the prices of recently sold homes that are similar in size, location, and amenities to yours. However, the art of pricing extends beyond simply aligning with market trends. It involves a nuanced consideration of your home’s unique features and any improvements that may enhance its value. Pricing too high can deter potential buyers, leaving your property to languish on the market, while setting the price too low might lead to a quicker sale but at the expense of significant financial loss.

Amid the complexities of setting the right price, leveraging the expertise of a real estate professional can prove to be advantageous. These experts bring to the table not only their knowledge of the market but also an understanding of buyer behavior and how to strategically position your home for sale. They can help you navigate the often emotional aspects of pricing, ensuring that decisions are grounded in data and aligned with your selling goals. Remember, the initial listing price is not just a starting point for negotiations; it’s a powerful marketing statement that can attract the right audience to your door. Adjustments may be necessary as the market reacts, but with a solid strategy, your home can be positioned competitively, facilitating a smoother and more successful selling journey.

Marketing Your Home Effectively

One of the pivotal steps in ensuring a successful sale of your home lies in strategic marketing. It begins with understanding the unique selling points of your property and leveraging these features to attract potential buyers. High-quality photographs and compelling property descriptions form the backbone of any effective real estate marketing strategy. These elements should highlight the key attributes of your home, from natural lighting and spacious layouts to modern amenities and energy-efficient systems. It’s equally important to choose the right channels for advertising, with a mix of digital platforms, social media, and traditional real estate listings being essential to reach a broad audience.

Furthermore, virtual tours and open houses play a crucial role in marketing your home effectively. In today’s digital age, virtual tours offer an immersive experience, allowing prospective buyers to explore your property from the comfort of their homes. This is particularly useful in capturing the interest of out-of-town buyers or those with busy schedules. Open houses, on the other hand, provide a personal touch, giving buyers the opportunity to experience the space firsthand and envision their lives within it. Both tactics are instrumental in creating a strong emotional connection with potential buyers, which is often a critical factor in their decision-making process.

Preparing Your Home For The Market

When considering selling your home, preparing it for the market is a pivotal step that can substantially influence both its sale price and time on the market. Initially, conducting a thorough cleaning and decluttering process is paramount. This not only enhances the aesthetic appeal of your home but also allows potential buyers to envision themselves living in the space. Spaces free of personal items and clutter provide a blank canvas for buyers, enabling them to project their own dreams and preferences onto the property. In addition to cleaning and decluttering, addressing any minor repairs or maintenance issues is crucial. These repairs might include fixing leaky faucets, patching holes in walls, or updating any dated fixtures. Such attention to detail can significantly impact the first impressions of potential buyers and suggest a well-maintained home.

Beyond the basics of cleaning and repairing, staging your home plays a key role in attracting buyers. Professional staging can highlight your home’s strengths while minimizing its weaknesses, illustrating the property’s potential. The arrangement of furniture and décor is designed to maximize space and flow, making rooms appear larger and more inviting. Moreover, adjusting lighting to ensure spaces are well-lit can create an inviting atmosphere that enhances the home’s features. Neutral colors and minimalistic designs tend to appeal to a broader audience, making it easier for buyers to imagine personalizing the space. While professional staging is an investment, it often yields a high return by increasing the home’s perceived value and reducing its time on the market. These preparatory steps underscore the importance of presenting your home in the best possible light, setting the stage for a successful sale.

In summary, mastering the art of selling your home requires a multifaceted approach encompassing a strategic pricing setup, effective marketing, meticulous preparation for market readiness, and a smooth navigation of the closing process. By adhering to the essential tips outlined in this article, sellers can enhance their chances for success, ensuring not only a swift sale but also one that maximizes their financial gain. Embrace these guidelines with a professional outlook, and you’ll be well-equipped to turn the complex journey of selling your home into a rewarding and successful endeavor.