3 Benefits to Buying Your Dream Home This Year

Outside of a strong economy, low unemployment, and higher wages, there are three more great reasons why you may want to consider buying your dream home this year instead of waiting.

1. Buying a Home is a Great Investment

Several reports indicate that real estate is a good investment, topping other options such as gold, stocks, bonds, and savings. Why? Real estate helps build equity, a form of investing for you and your family. According to CoreLogic’s Equity Report,

“U.S. homeowners with mortgages (roughly 64% of all properties) have seen their equity increase by a total of nearly $457 billion since the third quarter 2018, an increase of 5.1%, year over year.”

This means the average homeowner gained approximately $5,300 in equity over the past year. If you want to start building your equity, put your housing costs to work for you through homeownership this year.

2. Mortgage Interest Rates Are Low

The Primary Mortgage Market Survey from Freddie Mac indicates that interest rates for a 30-year mortgage have fallen since November 2018 when they hit 4.94%. In their latest forecast, Freddie Mac expects rates to remain low, leveling out to a yearly average of 3.8% in 2020.

When you purchase a home at a low mortgage rate, it will impact your monthly mortgage payment, giving you the opportunity to buy more house for your money.

3. Investing in Your Family is a Win

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you’re living rent-free with your parents, you’re paying a mortgage – either yours or that of your landlord.

Today, rental prices continue to increase, and when you’re paying your landlord’s mortgage instead of your own, you’re not the one earning the equity. As an owner, your mortgage payment is a form of ‘forced savings’ you can use later in life to reinvest in your family. You can use it for a variety of opportunities, such as saving for your children’s education, moving up to a bigger home, or starting your own business. As a renter, it can be more challenging to achieve those types of dreams without home equity working for you.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings and long-term financial growth for you and your family. Let’s get together to determine if homeownership is the right choice for you this year.

Utah Real Estate Tip – there are no “easy” transactions.

Real Estate Legal Tip - there are no "easy" transactions.Some people say that when the market is hot, "I can sell my home myself," or "I don't need an experienced agent because it costs money," or "how hard can it be?"Curtis Bullock From the Salt Lake Board of...

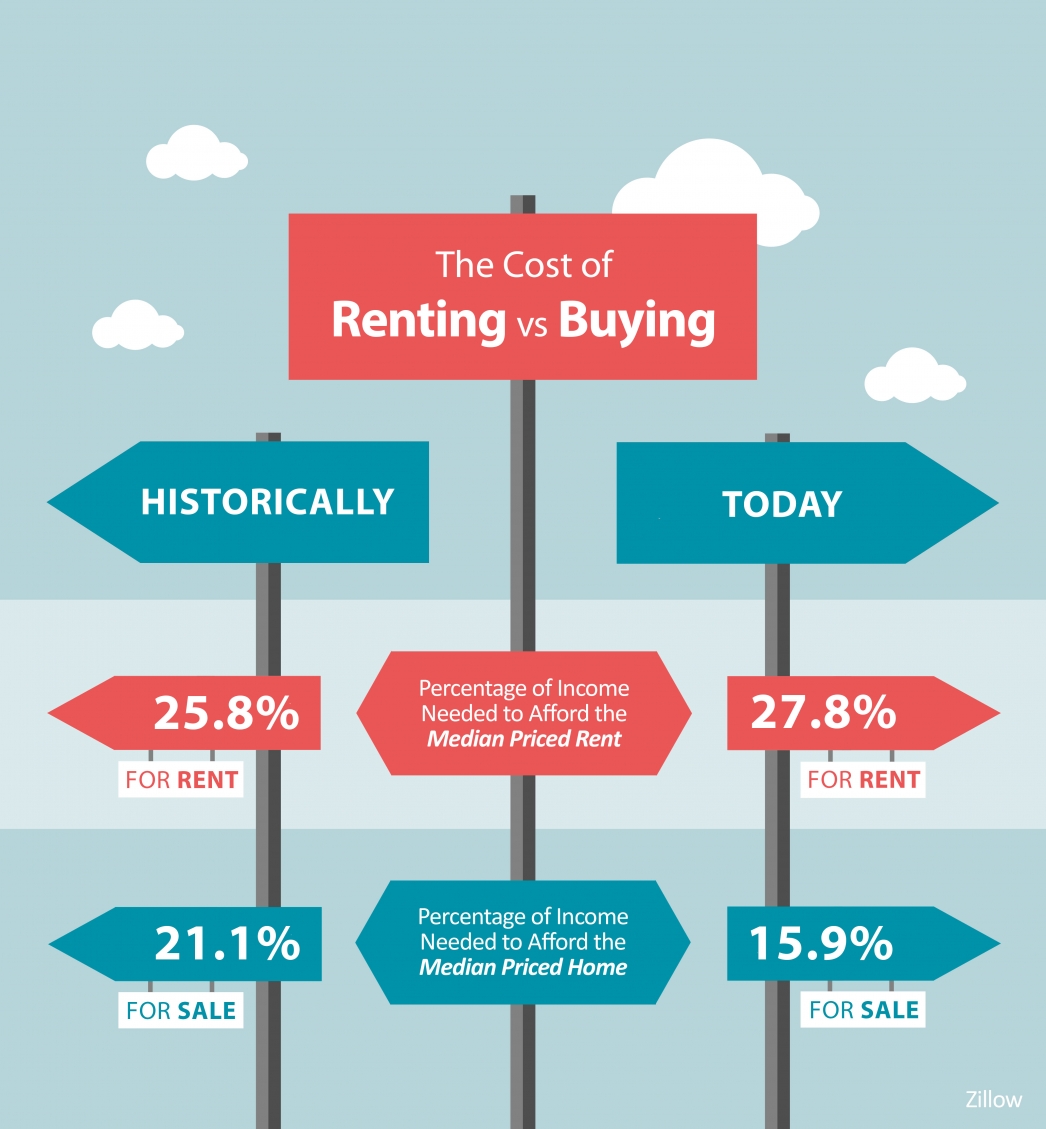

The Cost of Renting Vs. Buying a Home

The Cost of Renting Vs. Buying a HomeSome HighlightsThe percentage of income needed to afford a median-priced home today is declining, while that for renting is on the rise.This is making buying a home an increasingly attractive option for many people, especially with...

Forbearance Numbers Are Lower Than Experts Forecasted

Forbearances have stayed well under the rate experts initially forecasted. Let's connect if you have questions about your options.

Top Reasons People Are Moving This Year In 2020

The Top Reasons People Are Moving This YearToday, Americans are moving for a variety of different reasons. The current health crisis has truly re-shaped our lifestyles and our needs. Spending extra time where we currently live is enabling many families to re-evaluate...

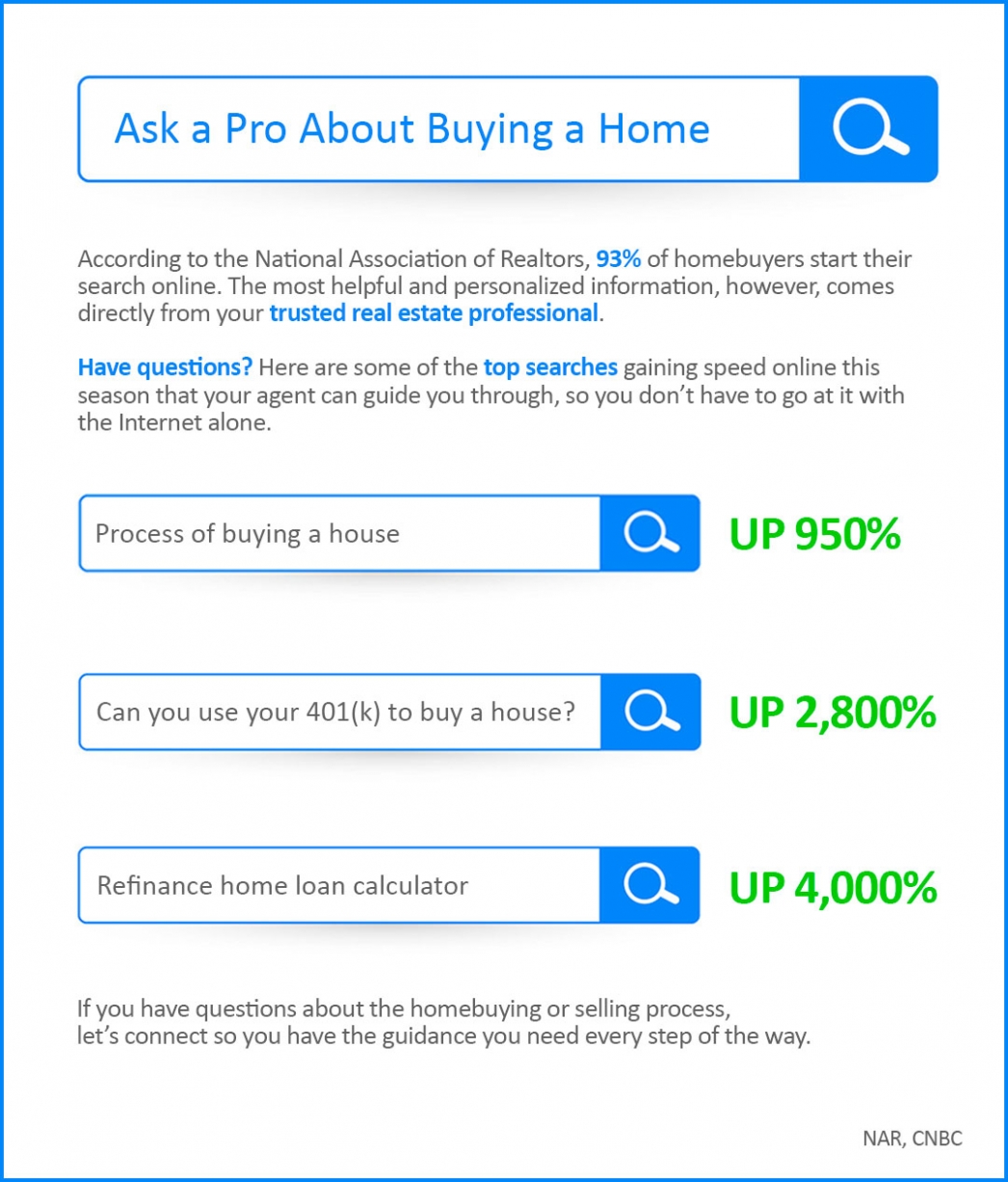

Ask a Pro About Buying a Home

Ask a Pro About Buying a Home Some HighlightsAccording to trending data, searches for key real estate topics are skyrocketing online.Clearly, lots of people have questions about buying a home, and other topics related to the process.Working with a trusted real estate...

Home Has a Whole New Meaning Today

Forbearance Numbers Are Lower than Expected

Forbearance Numbers Are Lower than ExpectedOriginally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some...

Are you Thinking About Selling? Sellers Are Returning to the Housing Market

Sellers Are Returning to the Housing MarketGet Your PEAR Report Today! (Professional Equity Assessment Report)In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand....

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...

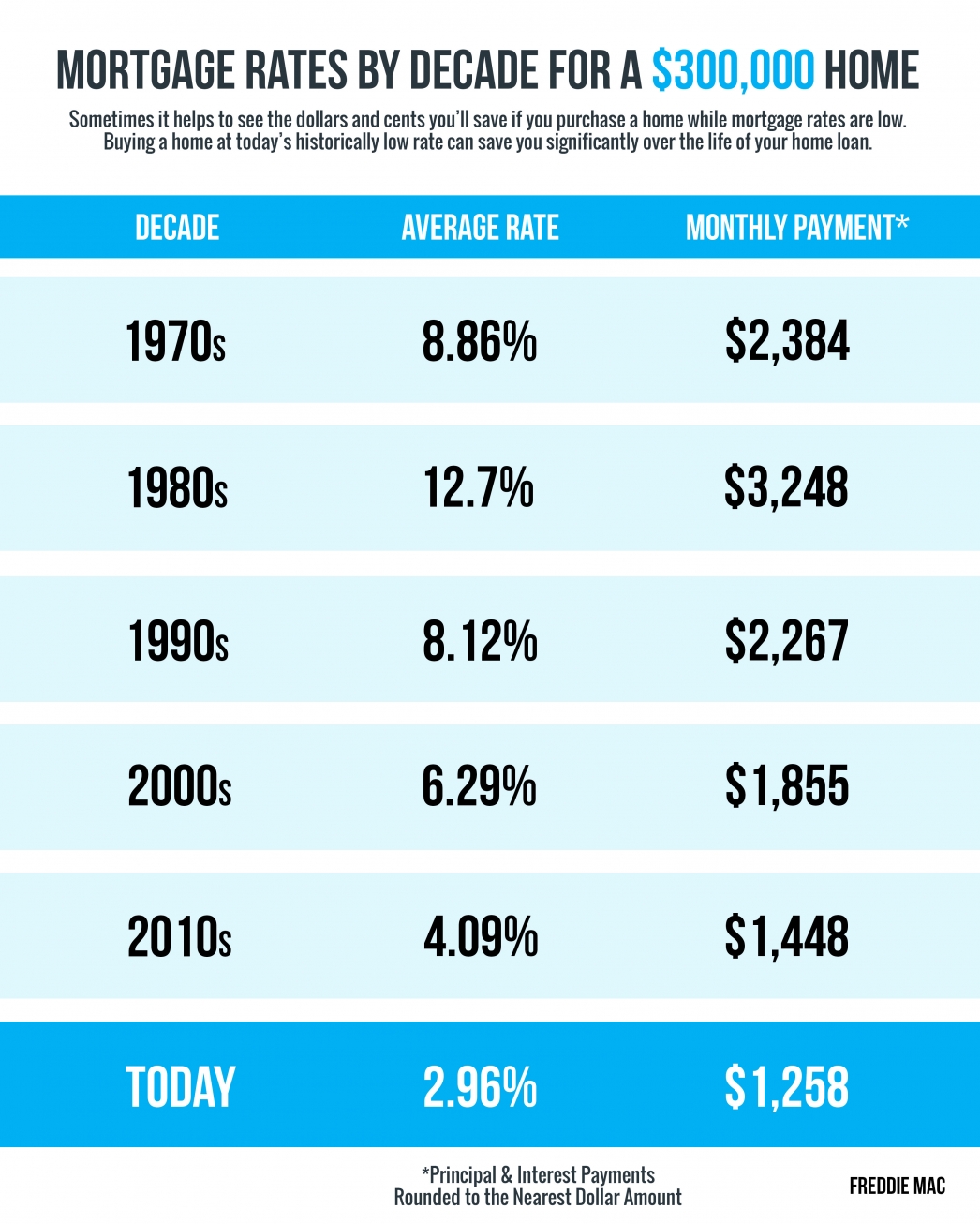

Mortgage Rates and Payments by Each Decade

Mortgage Rates & Payments by DecadeSome HighlightsSometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your...