The Feeling You Get from Owning Your Home

We often talk about the financial reasons why buying a home makes sense. But, more often than not, the emotional reasons are the more powerful and compelling ones.

No matter what shape or size your living space is, the concept and feeling of home can mean different things to different people. Whether it’s a certain scent or a favorite chair, that feeling of safety and security you gain from owning your own home is simultaneously one of the greatest and most difficult to describe.

Frederick Peters, a contributor for Forbes, recently wrote about that feeling, and the pride that comes from owning your own home.

“As homeowners discover, living in an owned home feels different from living in a rented home. It’s not just that an owner can personalize the space; it touches a chord even more fundamental than that.

Homeownership enhances the longing for self-determination at the heart of the American Dream. First-time homeowners, young or old, radiate not only pride but also a sense of arrival, a sense of being where they belong. It cannot be duplicated by owning a 99-year lease.”

Bottom Line

Owning a home brings a sense of accomplishment and confidence that cannot be achieved through renting. If you are debating renewing your lease, let’s get together before you do to answer any questions you may have about what your next steps should be, and what is required in today’s market!

The Perks of Downsizing When You Retire

The Perks of Downsizing When You Retire Some Highlights If you’re about to retire, or just did, downsizing can be a good way to try to cut down on some of your expenses. Smaller homes typically have lower energy and maintenance costs. Plus, you may have...

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing....

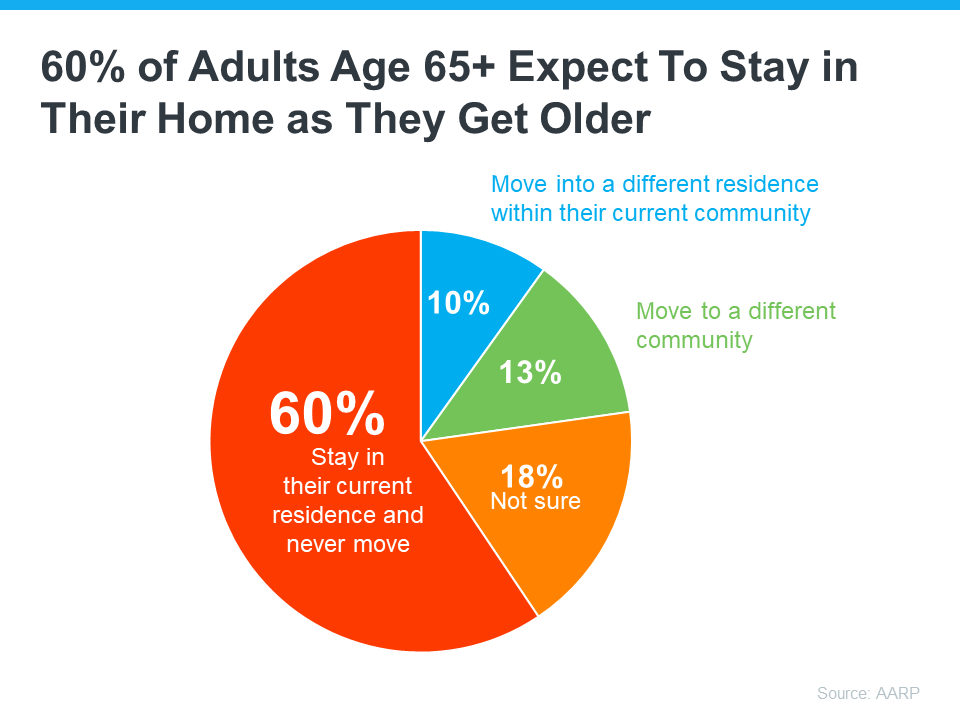

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami Have you heard the term “Silver Tsunami” getting tossed around recently? If so, here’s what you really need to know. That phrase refers to the idea that a lot of baby boomers are going to move or downsize...

Utah Licensed Real Estate Agents

In the past, we have had over 30,000 Active licenses. At the End of 2023 here is where we stand. Data is sourced from the Utah Division of Real Estate 22, 853 Active Licensees Sales Agent - 18,517 Principal Broker - 2442 Branch Broker - 171 Inactive - 4016 In...

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence Moving into a new residence marks a significant milestone that brims with excitement and potential. However, to translate this new beginning into a seamless transition, careful planning and a...

3 Helpful Tips for First-Time Homebuyers

3 Helpful Tips for First-Time Homebuyers Some Highlights Trying to buy your first home? If you’re worried about affordability today or the limited number of homes for sale, these tips can help. Look into homebuyer programs, expand your search area, and consider...

Short list of things that you must get rid of before moving

Embarking on a new chapter of your life by relocating to a different home can be an exciting yet daunting process. The key to ensuring a smooth and stress-free move lies in effective preparation and organization, of which a critical component is the pre-move purge....

What Are Experts Saying About the Spring Housing Market?

What Are Experts Saying About the Spring Housing Market? If you’re planning to move soon, you might be wondering if there'll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market. If so, here's what the...

NAR Lawsuit Update – How does this effect Utah Realty?

NAR Lawsuit Update What we Know.... The NAR has reached a settlement agreement on the class action lawsuits relating to the offer of compensation rule. Details are in the link below. There is much to digest and more info and training will come out in the days ahead....

Why Access Is So Important When Selling Your House

Why Access Is So Important When Selling Your House If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to...