Maximizing The Benefits Of Home Equity When Downsizing

When it comes to downsizing, homeowners often view it as a way to simplify their lives, reduce maintenance costs, or even relocate to a more desirable location. But what many don’t realize is that downsizing can also be an opportunity to tap into the built-up home equity and maximize its benefits.

Home equity refers to the portion of the home’s value that you own outright, and it can be a game-changer when you decide to sell and downsize. By carefully strategizing and making thoughtful financial decisions, you can make the most of your home equity and use it to enhance your financial situation and overall quality of life.

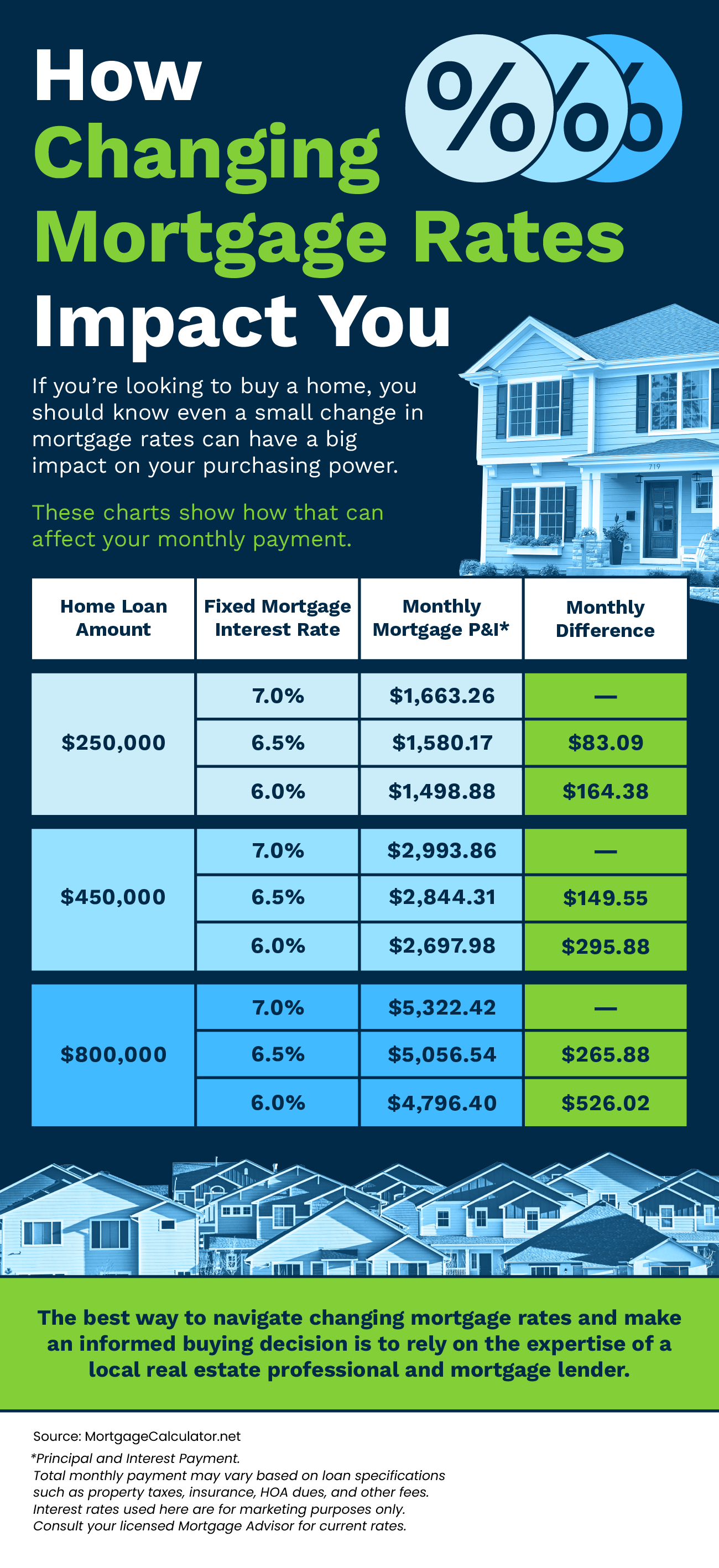

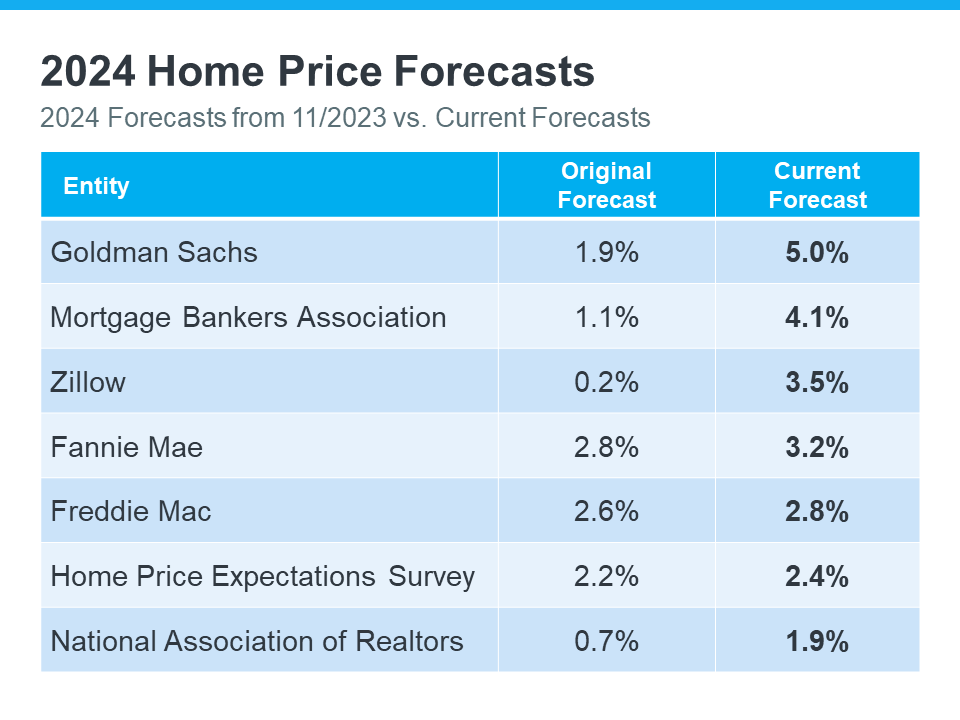

One of the primary benefits of downsizing is the potential to accumulate a significant amount of home equity. Suppose you have lived in your current home for a considerable period of time or experienced a rise in property values in your area. In that case, you may have built up substantial equity over the years. When you sell your current property and purchase a smaller one, you can unlock that equity and put it to work for you.

So, how can you maximize the benefits of home equity when downsizing? Here are some key strategies to consider:

1. Evaluate Your Financial Goals: Before making any decisions, it’s essential to define your financial goals. Are you looking to reduce monthly expenses, pay off debts, invest, or enhance your retirement savings? By clearly identifying your objectives, you can align your use of home equity with your financial aspirations.

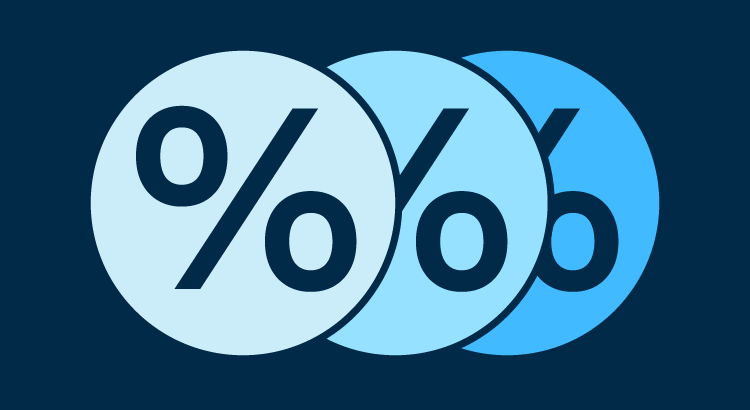

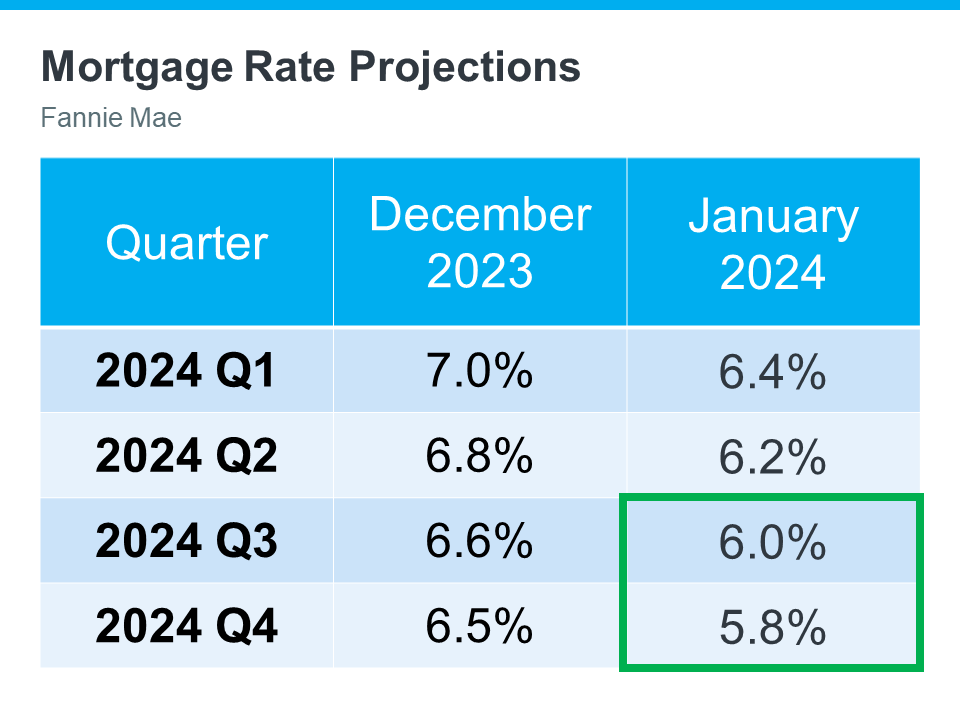

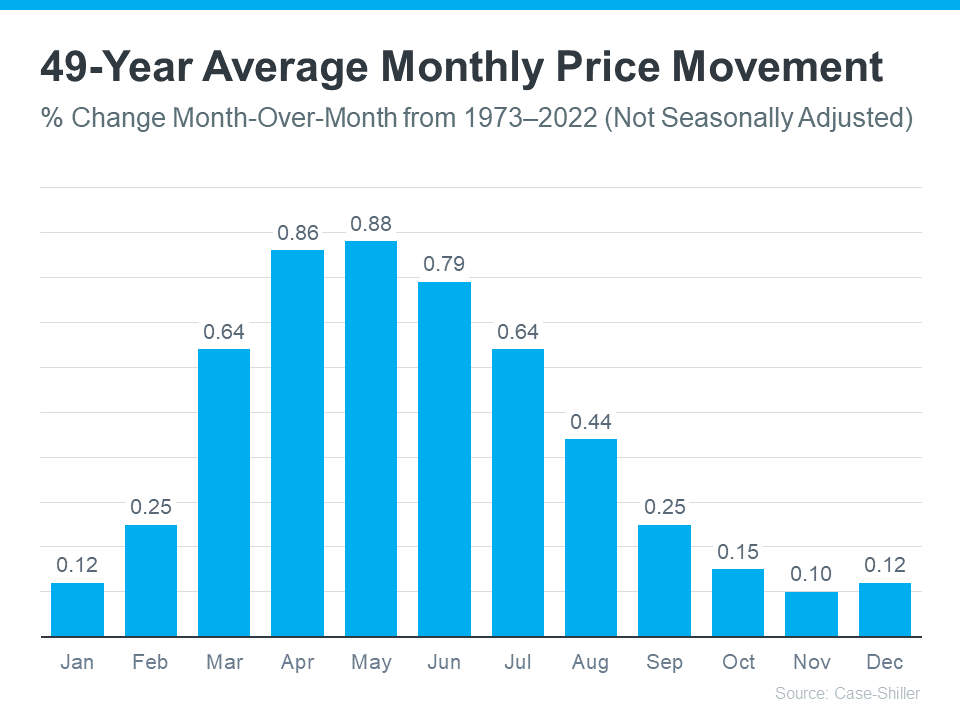

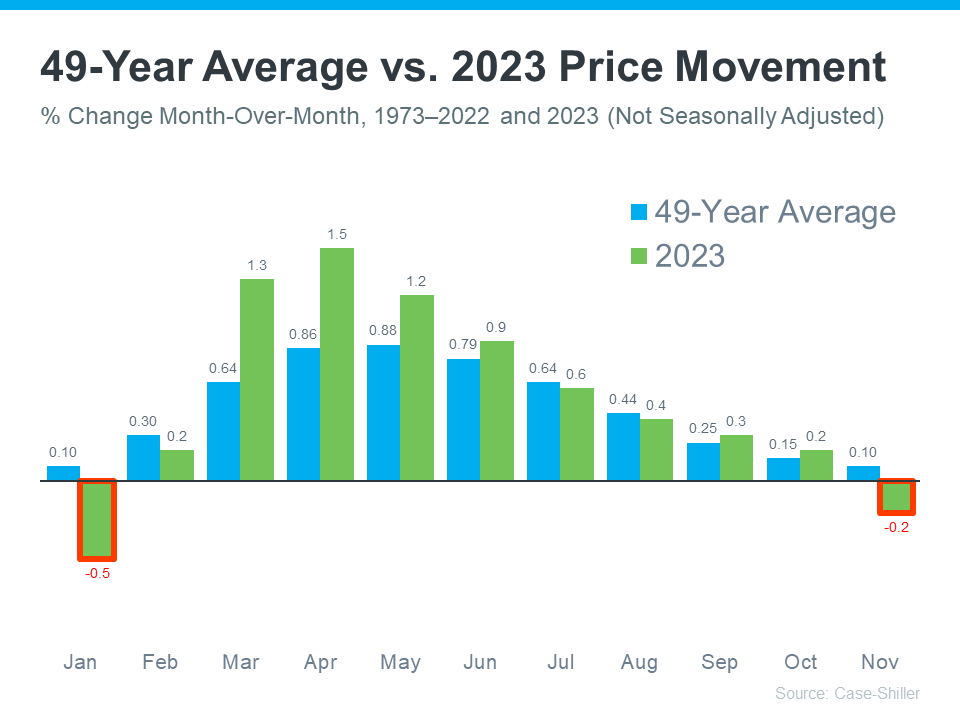

2. Assess the Real Estate Market: Familiarize yourself with the current real estate market conditions, both in your current location and where you plan to downsize. Understanding property values, market trends, and buyer demand will help you determine the potential selling price of your existing home and the affordability of downsizing options.

3. Plan for a Smaller Mortgage (or None): Downsizing often means purchasing a smaller and less expensive property, and that can lead to a reduced mortgage or even eliminate it entirely. By using the proceeds from the sale of your current home and applying it towards a smaller mortgage or buying a property outright, you can significantly lower your monthly housing expenses.

4. Consider Cash Offers: Depending on the current housing market, you might receive cash offers for your existing home. A cash offer can be advantageous when downsizing as it allows you to skip the traditional sale process, eliminate the need for mortgage approvals, and provide you with immediate access to your home equity.

5. Explore Reverse Mortgages: If you are 62 or older, a reverse mortgage can be a viable option to leverage your home equity when downsizing. A reverse mortgage allows you to borrow against your home equity while still living in your home. This can provide additional funds that can be used to purchase a smaller property, supplement retirement income, or cover other expenses.

6. Invest Wisely: If you are considering investing your home equity, it’s essential to carefully evaluate your options and consult with a financial advisor. Depending on your risk tolerance and financial goals, you may choose to invest in stocks, bonds, real estate, or other investment vehicles. Proper planning and diversification can help you grow your wealth and secure your financial future.

7. Consult with a Financial Advisor: Downsizing and utilizing home equity can have significant financial implications. Seeking guidance from a financial advisor can help you make informed decisions, understand the impact on your overall financial picture, and ensure that you are maximizing the benefits of your home equity effectively.

Downsizing presents an opportunity to leverage the value you have accumulated in your current home to enhance your financial situation and meet your long-term goals. By carefully considering your options, evaluating the real estate market, and seeking expert advice, you can make the most of your home equity and secure a brighter future when you sell and downsize.

The Power Of Home Equity: Understanding The Basics

Homeownership is often considered as a great investment, providing financial stability and a sense of security. One of the major advantages of owning a home is the build-up of equity over time. Home equity is the difference between the market value of your property and the outstanding balance on your mortgage.

Understanding the basics of home equity is crucial, as it can play a significant role in your financial planning, especially when the time comes to sell and downsize. By utilizing the power of home equity, you can potentially unlock a range of opportunities and transform your financial situation.

When you sell your home and downsize, you have the potential to free up a substantial amount of home equity. This equity can be used in various ways, depending on your financial goals and circumstances. Let’s explore some of the options available to homeowners:

1. Boosting Your Retirement Savings: Downsizing can provide an excellent opportunity to increase your retirement nest egg. By using the proceeds from selling your home to contribute to your retirement savings, you can secure your financial future and potentially enjoy a more comfortable retirement.

2. Purchasing a Smaller Home: Downsizing often involves selling your current home and purchasing a smaller, more affordable property. By doing so, you can eliminate the burden of a large mortgage payment and potentially reduce your monthly expenses. This can afford you more financial flexibility and freedom to pursue other interests or invest in your passions.

3. Eliminating Debt: If you have high-interest debt, such as credit card debt or personal loans, downsizing can be a smart way to pay it off. By using your home equity to clear these debts, you can save on interest payments and get on a path towards financial freedom.

4. Investing in Other Opportunities: Home equity can be a valuable resource to explore new investment avenues. Whether it’s starting a business, investing in stocks, or purchasing another property to generate rental income, utilizing your home equity can provide a launching pad for alternative revenue streams.

5. Enhancing Your Lifestyle: Downsizing can also present an opportunity to upgrade certain aspects of your life. By using the proceeds from selling your home, you can invest in renovations or upgrades for your new, smaller property. This can help create a more comfortable and enjoyable living space that suits your evolving needs and preferences.

While the possibilities are exciting, it’s important to be mindful of the potential risks and ensure that downsizing aligns with your long-term financial plans. Before making any decisions, it’s advisable to consult with a financial advisor or real estate professional who can provide expert guidance tailored to your specific circumstances.

In conclusion, understanding the power of home equity can be a game-changer when you sell and downsize. By tapping into the equity built up in your home, you can unlock a range of financial possibilities that can significantly enhance your financial well-being. From bolstering your retirement savings to eliminating debt and exploring new investment opportunities, home equity can offer a fresh start and lay the foundation for a prosperous future. So, when the time comes to downsize, don’t overlook the potential of your home equity and consider how it can positively impact your financial journey.

Strategies For Selling And Utilizing Home Equity Wisely

When it comes to selling your home and downsizing, home equity can truly be a game changer. Home equity is the difference between the current market value of your home and the amount you owe on your mortgage. It can provide you with additional financial flexibility and open up a world of possibilities as you embark on the next phase of your life. However, it is essential to utilize this equity wisely to maximize its potential benefits. In this section, we will explore some effective strategies for selling your home and utilizing home equity wisely.

1. Pay off existing debts: One of the first and most prudent ways to utilize your home equity is to pay off any existing debts you may have. Whether it’s credit card debt, car loans, or personal loans, using your home equity to eliminate these outstanding obligations can provide immense relief and improve your overall financial health. By consolidating your debts and focusing on repaying them, you can free up monthly income and reduce the burden of multiple payments.

2. Invest in your future: Selling your home and downsizing can be an opportune time to invest in your future. By setting aside a portion of your home equity, you can contribute to retirement funds, start a business, or explore other investment opportunities. It is crucial to consult with a financial advisor to determine the best investment options that align with your long-term goals and risk tolerance. Making informed decisions about where to put your home equity can help you secure a more stable and secure financial future.

3. Enhance your new residence: Downsizing often means transitioning to a smaller home or a different living situation. Utilizing your home equity to enhance your new residence can significantly improve your quality of life and make the downsizing process more enjoyable. Consider renovations or upgrades that will increase the value of your new property and make it more comfortable and suitable for your needs. Whether it’s updating the kitchen, installing energy-efficient systems, or creating a cozy outdoor living space, investing in your new residence can be a wise use of your home equity.

4. Establish an emergency fund: It’s always a good idea to have an emergency fund to cushion unexpected financial blows. Selling your home and downsizing can be an opportunity to establish or bolster this fund. By setting aside a portion of your home equity for emergencies, you can gain peace of mind and navigate unforeseen circumstances more comfortably. Whether it’s medical expenses, car repairs, or home maintenance, having a financial safety net can alleviate stress during challenging times.

5. Fund personal aspirations or hobbies: Downsizing and accessing home equity can also enable you to pursue personal aspirations or hobbies that may have been put aside due to financial constraints. Whether it’s traveling, starting a passion project, or taking up a new hobby, utilizing your home equity to support these pursuits can bring immense joy and fulfillment to your life. It’s essential to strike a balance between responsible use of your home equity and allocating funds towards activities that bring you happiness and personal growth.

In conclusion, selling your home and downsizing can be an exciting and transformative process. By utilizing your home equity wisely, you can unlock financial opportunities that can positively impact your life. Whether it’s paying off debts, investing in your future, enhancing your new residence, establishing an emergency fund, or pursuing personal aspirations, there are various strategies you can employ to make the most of your home equity. Remember to consult with professionals and make informed decisions that align with your goals and priorities. By doing so, you can leverage the power of home equity and set yourself up for a brighter financial future as you embark on this new chapter of your life.

Potential Pitfalls And Tips For Safeguarding Your Home Equity

While downsizing can offer a range of benefits, such as reducing expenses, minimizing maintenance, and simplifying one’s lifestyle, it’s crucial for homeowners to be aware of potential pitfalls that could impact their home equity. Safeguarding your home equity during the downsizing process should be a top priority to ensure you can fully leverage this valuable asset. In this section, we will discuss some potential pitfalls and offer tips for protecting your home equity.

1. Pricing your home correctly:

One of the most critical factors in safeguarding your home equity is accurately pricing your home when you put it on the market. Overpricing can lead to extended time on the market, reducing the chances of selling at the desired price. On the other hand, underpricing can result in leaving money on the table. Consulting with a reliable real estate agent or a professional home appraiser can greatly assist you in determining the optimal listing price for your property.

2. Timing the market:

The timing of selling your home can significantly impact your home equity. Real estate markets are dynamic and can experience fluctuations, affecting property values. Monitoring market trends and working with experienced real estate professionals can help you identify optimal periods to list your home and maximize your selling price.

3. Preparing your property for sale:

Investing some time and effort into preparing your property for sale can yield substantial returns in terms of enhanced home equity. Simple improvements like fresh paint, decluttering, and staging can significantly increase the perceived value of your home and attract potential buyers. Prioritize repairs and updates that provide the most impact without overspending, ensuring a good return on investment.

4. Avoiding excessive transaction costs:

When selling a property, there are certain costs involved, such as real estate agent commissions, closing costs, and transfer taxes. These expenses can eat into your home equity if not carefully managed. Comparing multiple real estate agents, negotiating commission rates, and exploring ways to minimize closing costs can help safeguard your home equity and ensure you keep more money in your pocket.

5. Minimizing debt:

Another essential aspect of safeguarding your home equity is to minimize your debt before downsizing. Paying off as much mortgage debt as possible can lower your monthly expenses and potentially unlock additional equity when you sell your home. Focusing on reducing your debt load and improving your credit score can open up more favorable financing options for your downsized property.

6. Considering alternative downsizing options:

Downsizing doesn’t always mean selling your current property and purchasing a smaller one. Exploring alternative downsizing options like rental properties, co-housing communities, or retirement villages can help you maintain your home equity while enjoying a lower-maintenance lifestyle. These alternatives often come with various benefits, such as access to shared amenities, reduced upkeep responsibilities, and potentially lower costs.

In conclusion, safeguarding your home equity while downsizing requires careful planning, diligent research, and strategic decision-making. By avoiding potential pitfalls and implementing the provided tips, you can significantly protect and leverage your home equity to ensure a smooth transition to your downsized dream home. Consulting with professionals along the way and prioritizing financial stability will help you maximize the benefits of downsizing while preserving your most valuable asset.